This is the 22nd edition of The BI & Analytics Survey. It has been conducted annually since 2000.

Based on a sample of over 1,400 survey responses, The BI & Analytics Survey 24 offers an unsurpassed level of user feedback on 21 leading business intelligence solutions.

Our research covers issues ranging from the purchase cycle right through to deployment, including critical information on performance levels, scalability and problems encountered.

Click the links below for in-depth descriptions of our survey methodology, the sample, the KPIs, the peer groups and much more:

Components of The BI & Analytics Survey

Instead of delivering one long document covering all aspects of The BI & Analytics Survey, we have split the information into several smaller documents. By providing the raw data via a web-based tool – The BI & Analytics Survey Analyzer – users have the ability to carry out their own analysis of the survey results. The BI & Analytics Survey 24 is divided into several documents, as listed below.

These documents do not need to be read in sequence. The Results, Best Practices and the Vendor Performance Summaries can be read independently.

The Results

The Analyzer

Best Practices

Vendor Performance Summaries

Sample & Methodology

The value of a survey like this depends on having a sufficiently large, well-distributed and unbiased sample. This section describes the characteristics of the people who took part in the study.

The BI & Analytics Survey 24 has the largest sample of any survey of business intelligence users available on the market. The BI & Analytics Survey has a rule that, as far as possible, only sub-samples containing 30 or more data points should be reported.

We apply increasingly stringent data cleansing rules, using a number of different tests. We remove all suspect data that purports to be from user sites.

Most surveys are conducted or sponsored by an organization based in, and focused on, one country. However, business intelligence and analytics is a worldwide market and we wanted, as far as possible, to capture a large international sample. This not only presents a more accurate global picture but also allows international variations to be analyzed.

The largest business intelligence and analytics markets are the United States, Germany, France and the United Kingdom, so The BI & Analytics Survey 24 was produced as a collaboration between organizations in each of these countries, and in partnership with publishers and vendors in these and other countries. It features not just the well known US products, but also products from other regions including Europe and Australia.

Sample size and make-up

Hundreds of thousands of people around the world were invited to participate in The BI & Analytics Survey 24, using social media as well as dozens of email lists, magazines and websites.

As in previous years, the questionnaire offered different sets of questions for vendors and users (or consultants answering on behalf of users). This seems to produce better quality data as in the past some vendors pretended to be users when they saw they were not being asked relevant questions.

Participants from last year who indicated that they would like to be part of our panel received a pre-filled questionnaire with their answers from last year’s questions. They were asked to update their responses, and then to answer the new questions in this year’s survey.

The results of the online data collected are shown in the table, with the numbers of responses removed also displayed.

The number of responses is split between users, consultants and vendors. Vendors answered a different set of questions to those answered by users.

| Total responses | 1,480 |

| Filtered out during data cleansing | -43 |

| Remaining after data cleansing | 1,437 |

| Not yet considered buying | -36 |

| Total answering questions | 1,401 |

| Total responses analyzed | |

| Users | 1,118 |

| Consultants | 199 |

| All users | 1,317 |

| Vendors/Resellers | 84 |

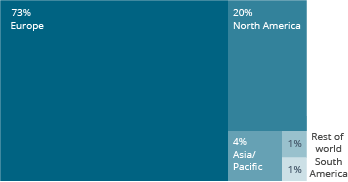

Geographical distribution

One of the key objectives of The BI & Analytics Survey is to achieve a geographically balanced sample that reflects the current global market for BI products. Therefore the online questionnaire was published in three languages: English, German and French.

Having a geographically balanced sample has a major benefit: the results of The BI & Analytics Survey are more closely representative of the world market, rather than being largely based on US experience, as is the case with many other surveys.

In regions where knowledge of English is sparse, such as South America and much of Asia and Southern Europe, it is difficult to obtain a good level of feedback and the BI market is less mature in these countries.

Since the fourth edition of The BI & Analytics Survey, we have significantly boosted the German sample by specifically targeting users in German-speaking countries, using a fully translated online questionnaire.

We also used a French questionnaire, further increasing our European coverage.

The net result was an extraordinarily international panel. Respondents were located in 71 countries. Three countries were represented by 100 or more respondents and one other country had more than 50. In total, 14 countries produced ten or more respondents.

Respondents analyzed by region (n=1,431)

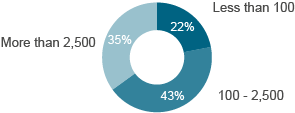

Organization sizes by headcount

Business intelligence and analytics products are most commonly found in large organizations and a high percentage of the responses we receive are from users in companies with more than 2,500 employees.

Nevertheless, we also have a high proportion of mid-sized companies in this year’s sample.

Frequency of employee count in respondent organization (n= 1,366)

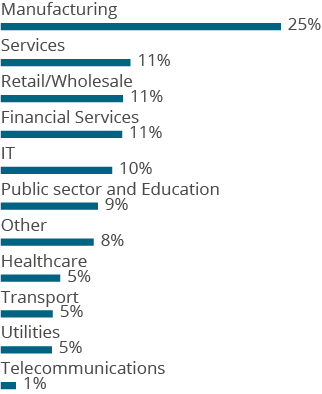

Vertical markets

We asked all respondents their company’s industry sector. The chart shows the results of this question and only includes data from respondents who answered product-related questions in The BI & Analytics Survey.

Having dominated the list for several years, manufacturing is still the best represented industry in The BI & Analytics Survey.

Respondents analyzed by industry (n=1,353)

Products in The BI & Analytics Survey

At least 29 user reviews are necessary to be included in the detailed BI product analysis. In this year’s BI & Analytics Survey we analyze 21 BI tools (or groups of products) in detail.

When grouping and describing the business intelligence solutions featured in The BI & Analytics Survey, we did not strictly follow the naming conventions that the vendors use. In some cases, we combined various BI products to make analysis more convenient. Note that the names we use in The BI & Analytics Survey are our own and are not always the official product names used by the vendors.

One of the key reasons for this is that the products we analyze are not necessarily the latest version of the tool. Vendors will often change a product’s name between versions, making it difficult to have a single official name for several versions of the same product.

Another reason is that we sometimes bundle related products into a single group to increase the sample size, even if the vendor prefers to view them as distinct for marketing reasons. In both these cases, the point is not to challenge the naming conventions of the vendor, but simply to reduce the complexity of the survey findings for the convenience of the reader. In some cases, we also shorten the names of the products to improve the formatting of charts.

We asked respondents explicitly about their experiences with products from a predefined list, with the option to nominate other products. This list is updated each year and is based on the sample size of the products in the previous year, as well as additional new products in the BI market. In cases where respondents said they were using an ‘other’ product, but from the context it was clear that they were actually using one of the listed products, we reclassified their data accordingly.

We solicited responses on all surviving products with more than a minimal response in last year’s survey, plus a few others whose numbers had potentially grown to the point where there would be enough data to be analyzed.

The table shows the products included in the detailed analysis.

The last few years have seen an increase in the proportion of German respondents. This is partly due to cooperation with German vendors and the presence of strong German subsidiaries of international vendors, reflected through providers such as SAP.

| Product | Number of reviews |

| Bissantz | 44 |

| DigDash | 38 |

| Entrinsik | 34 |

| IBM Cognos Analytics | 28 |

| IBM Planning Analytics | 30 |

| InfoZoom | 53 |

| Microsoft Excel | 61 |

| Microsoft Power BI | 183 |

| MicroStrategy | 74 |

| MyReport | 37 |

| Oracle Analytics Cloud | 33 |

| Pyramid | 29 |

| Qlik Sense | 81 |

| QlikView | 40 |

| SAP Analytics Cloud | 40 |

| SAP BO BI | 68 |

| Suadeo | 30 |

| Tableau | 70 |

| TARGIT | 29 |

| Zoho Analytics | 33 |

Want to rate your BI and analytics software?

Share your experience in the world‘s largest and most comprehensive survey of BI software users

Take part in The BI & Analytics SurveyThe Peer Groups

The BI & Analytics Survey 24 features a range of different types of BI and analytics tools so we use peer groups to help identify competing business intelligence products. They are used to ensure similar BI tools are compared against each other.

The groups are essential to allow fair and useful comparisons of BI tools that are likely to compete. The peer groups are primarily based on the results from The BI & Analytics Survey, how customers say they use their products and our knowledge of those products.

Segmentation is based on four key factors:

- Focus – Is the product focused on and typically used for reporting and dashboards, analysis or embedded analytics?

- Specialization – Is the vendor a BI and analytics specialist or a business software generalist, offering a broader portfolio of enterprise software for a variety of business requirements?

- Usage scenario – Is the product typically used in midsize/departmental implementations or large/enterprise-wide implementations?

- Global presence – Does the vendor have a global reach and offer its products worldwide?

Peer groups act as a guide to the reader to help make the products easier to understand and to show why individual products return such disparate results. They are not intended to be a judgment of the quality of the products. Most products appear in more than one peer group.

These peer groups are used in a consistent way in our analysis as well as in The BI & Analytics Survey Analyzer.

Includes products that focus on ad hoc query, data navigation and analysis.

BI & Analytics specialists are software vendors who focus solely on BI and/or analytics. Often, they have just one product in their portfolio.

Business software generalists have a broad product portfolio that is not limited to BI and analytics, including most (or all) types of enterprise software for a variety of business requirements (e.g., ERP).

Includes reporting and analytics products that can be embedded in other business applications (e.g., ERP systems).

Includes products from companies with annual revenues of $200m+ and a truly international reach (partner ecosystem, on-site locations, global installations and revenues).

Products in this peer group are typically (but not exclusively) used in large scenarios and/or enterprise-wide implementations with a large number of users and data volumes.

Products in this peer group are typically (but not exclusively) used in small and midsize scenarios and/or departmental implementations with a moderate number of users and data volumes.

Includes products that focus on the creation and distribution of standardized and governed content such as dashboards or reports.

The KPIs

The goal of the KPIs is to help the reader spot winners and losers in The BI & Analytics Survey 24 using well designed dashboards packed with concise information. The BI & Analytics Survey includes 6 aggregated KPIs, which can be absorbed at a glance. It also includes a set of 24 normalized KPIs, which we refer to as ‘root’ KPIs for each of the 21 products. The ‘aggregated’ KPIs are aggregations of these root KPIs.

This year we have calculated a set of KPIs for each of the 8 peer groups. The values are normalized on the whole sample. Peer groups are used to enable fair and useful comparisons of products that are likely to compete.

The KPIs all follow these simple rules:

- Only measures that have a clear good/bad trend are used as the basis for KPIs.

- KPIs may be based on one or more measures from The BI & Analytics Survey.

- Only products with samples of at least 20 – 30 (depending on the KPI) for each of the questions that feeds into the KPI are included.

- For quantitative data, KPIs are converted to a scale of 1 to 10 (worst to best).

- A linear min-max transformation is applied, which preserves the order of, and the relative distance between, products‘ scores.

- In some instances, adjustments are made to account for extreme outliers.

KPIs are only calculated if the samples have at least 15-30 data points (this varies depending on the KPI) and if the KPI in question is applicable to a product. Therefore some products do not have a full set of root KPIs. It is important to exclude KPIs based on small (and therefore not representative) samples to ensure that the graph scales are not distorted by outlier KPIs.

Measuring business benefits – the BBI and best-in-class companies

Business benefits are the real reason for carrying out any BI project and The BI & Analytics Survey has been studying them directly for years. We ask respondents the extent to which they realize a list of benefits with their BI tools.

For each potential benefit, respondents are asked to indicate the level of achievement, if any, with five levels. We use a weighted scoring system to derive a composite score for each of the possible benefits, based on the level of benefit achieved. We call this the BBI (Business Benefits Index).

This rating system is the basis of the most important index in The BI & Analytics Survey. It is a dimensionless number with an arbitrary value, but as long as the weighting system remains constant it can be used for comparisons between segments of the sample, such as the sample for individual products or regions, to name just two.

Throughout The BI & Analytics Survey, we use a classification of best-in-class companies and laggards. Best-in-class companies comprise the top 10 percent of companies, based on their achievement of business benefits, while laggards are defined as the 10 percent of companies achieving the lowest level of business benefits. This classification enables us to examine correlations between best-in-class/laggard companies and high (or low) KPI scores, and to identify what the most successful companies do differently to laggards.

For a more detailed description of the KPIs and how we calculated them, see our Sample, KPIs and Methodology PDF.

| Aggregated KPIs | Root KPIs |

| Business Value | Business Benefits |

| Project Success | |

| Project Length | |

| Competitiveness | Considered for Purchase |

| Competitive Win Rate | |

| Customer Satisfaction | Price to Value |

| Recommendation | |

| Vendor Support | |

| Implementer Support | |

| Product Satisfaction | |

| Sales Experience | |

| Functionality | Dashboards & Reports |

| Distribution of Reports | |

| Analyses & Ad Hoc Query | |

| Advanced & Predictive Analytics | |

| Data Preparation | |

| Mobile BI | |

| Innovation | Cloud BI |

| Visual Analysis | |

| Operational BI | |

| Embedded BI | |

| User Experience | Ease of Use |

| Flexibility | |

| Performance Satisfaction |