Finding the Right Planning and Budgeting Software To Suit Your Needs

What is the best planning and budgeting tool? What do users think of their planning tools? Is the best planning and budgeting software also the right one for my business? Which are the most important criteria when comparing products? And how highly do independent analysts rate various planning solutions?

Comparing planning and budgeting tools is not straightforward, especially as there are so many products on the market, all promising they will deliver business benefits and simultaneously solve all manner of problems.

To make the search for a suitable planning and budgeting tool easier, this article offers a balanced view of what software users – as well as BARC analysts – have to say about the leading products on the market.

By combining our in-depth knowledge of current planning software tools with one of the largest databases of user reviews of planning software, we aim to guide you through the first steps to finding the best planning tool for your company.

We believe a combined view of user feedback and in-depth analyst perspective is necessary to fully appreciate how planning and budgeting software tools compare against each other, and to understand which are the best fits for your company.

This article will reveal:

- what are the best planning and budgeting tools as rated by users in 2023

- how BARC analysts rate and compare planning and budgeting products (BARC Score: Integrated Planning and Analytics)

The Planning Survey: Head-to-head Planning Tools Comparison

The Planning Survey 23 is based on findings from the world’s largest and most comprehensive survey of planning software users, conducted from November 2022 to February 2023. In total, 1,267 people responded to the survey with 1,046 answering a series of detailed questions about their use of a named product. Altogether, 19 products are analyzed in detail.

This edition features a broad range of planning software tools, taking in products from international software giants as well as specialist tools from much smaller providers.

Only products with 30+ user reviews are included in the detailed analysis.

Since not all planning tools are alike, we use peer groups to ensure similar products are compared against each other. The groups are designed to enable fair and useful comparisons of planning and budgeting tools that are likely to compete.

Why we use peer groups

Not all planning and budgeting tools are the same. The Planning Survey 23 analyzes user feedback from a variety of different planning, budgeting and forecasting products so we use peer groups to help identify those that are most likely to compete. Some products appear in more than one group. Each peer group has been defined by BARC analysts, based on their experience and judgment.

The point to the peer groups is to ensure that the product comparisons we make in The Planning Survey make sense. The products are grouped together as we would expect them to appear in a software selection short list.

To make a proper choice, buyers should first segment the market into the types of product that match their organization’s requirements. Peer groups are intended to help with this task.

Peer group segmentation is based on four key factors:

- Focus – Is the product focused on and typically used for planning, budgeting and forecasting (e.g., finance, sales & operations, HR, etc.), financial consolidation or business intelligence and analytics?

- Specialization – Is the vendor a performance management/planning specialist or a business software generalist, offering a broader portfolio of enterprise software for a variety of business requirements?

- Usage scenario – Is the product typically used in midsize/departmental implementations or large/enterprise-wide implementations?

- Geographical presence – Does the vendor have a global reach and offer its product(s) worldwide?

The KPIs

Business Value is among the most important KPIs in The Planning Survey, focusing on the bottom-line benefits of planning projects. Any planning and budgeting software that does not deliver broad business value is superfluous.

The Business Value KPI indicates just how successful planning and budgeting software products are at providing benefits in the real world. This aggregated KPI combines the Business Benefits, Project Success and Project Length KPIs.

Since the market is highly competitive, delivering a superior user experience is more important than ever. Planning and BI professionals demand flexible, feature-rich products that offer comprehensive planning functionality for an integrated enterprise planning approach enhanced by inherent reporting and analysis functionality. However, they don’t want to spend a lot of time figuring out how the product works, attempting to learn complex interfaces or waiting around for planning calculations to finish. With the current vogue for agility, ease of use and self-service capabilities in business departments, and the need to access source systems for transferring actuals, user experience is an important consideration for many organizations evaluating planning tools.

To calculate the quality of user experience of a planning tool, we combine the Self-Service, Flexibility, Ease of Use and Performance Satisfaction KPIs.

If a vendor has lots of happy customers, it usually means they have a good product. We combine the Price to Value, Recommendation, Product Satisfaction, Vendor Support, Implementer Support and Sales Experience KPIs to calculate an aggregated Customer Satisfaction KPI. These factors are interlinked: If one is lacking, then the importance of the others is accentuated.

The Competitiveness KPI gives an insight into how planning and budgeting tools perform in a competitive selection process as well as the strength of a product’s market presence. It combines the Considered for Purchase and Competitive Win Rate KPIs.

An understanding of which tools have fared well (or not so well) in other organizations’ product selections is a valuable commodity that enables users to eliminate ‘losers’ at an early stage in the selection process.

Year after year, feedback from BARC survey participants underlines just how critical it is to consider the functionality of a product when evaluating it. After all, what use would the software be if it were incapable of enabling us to perform the tasks required of it? We combine the Predefined Connectors, Data Integration, Planning Content, Planning Functionality, Workflow, Forecasting, Simulation, Reporting/Analysis and Financial Consolidation KPIs to calculate this aggregated KPI.

New ideas and technologies are the lifeblood of the software industry. However, some vendors prefer to rest on their laurels, relying on existing technologies and lucrative maintenance contracts with loyal customers. If a planning tool cannot keep up with recent developments, it becomes outdated very quickly and cannot deliver the same level of benefits as rival tools. We combine the Cloud Planning, Driver-Based Planning and Predictive Planning KPIs to calculate this aggregated KPI.

The KPI rules

Only measures that have a clear good/bad trend are used as the basis for KPIs.

KPIs may be based on one or more measures from The Planning Survey.

Only products with samples of at least 20 – 30 (depending on the KPI) for each of the questions that feeds into the KPI are included.

For quantitative data, KPIs are converted to a scale of 1 to 10 (worst to best). A linear min-max transformation is applied, which preserves the order of, and the relative distance between, products‘ scores.

The peer groups

Besides planning and performance management, BI and analytics-focused products also target use cases such as reporting, dashboarding, (ad hoc) analysis and advanced analytics.

Business software generalists have a broad product portfolio including most (or all) types of enterprise software for a variety of business requirements (e.g., ERP).

Besides planning, financial consolidation-focused products have a strong focus on group consolidation and close processes. Typically, these products are standardized applications that offer built-in financial intelligence with predefined business rules for financial management as well as supporting use cases such as financial planning (P&L, balance sheet, cash flow).

Global vendors have a truly global sales and marketing reach. They are present worldwide, and their products are used all around the world.

Products in this peer group are typically (but not exclusively) used in large scenarios and/or enterprise-wide implementations with a large number of users.

Products in this peer group are typically (but not exclusively) used in small and midsize scenarios and/or departmental implementations with a moderate number of users.

Performance management specialists are software vendors who focus solely on performance management and/or planning. Often, they have just one product in their portfolio.

Planning-focused products support planning, budgeting and forecasting processes. Since The Planning Survey is focused on exactly this use case, this peer group includes all of the products featured in the survey. Planning-focused products often offer flexibility to model a wide range of individual sub-plans (financial, operational, strategic, etc.) but may also include predefined planning solutions designed for particular applications.

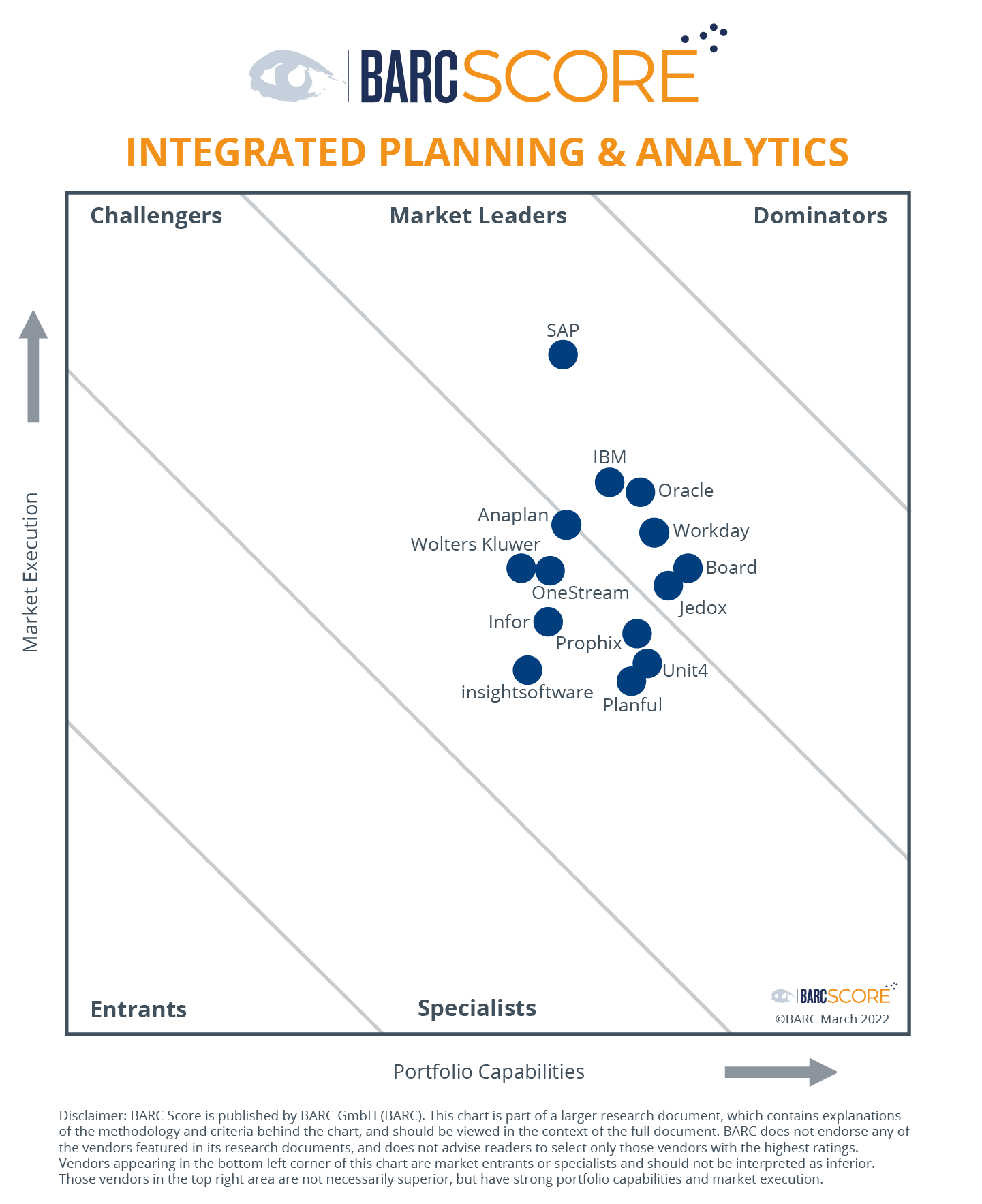

BARC Score – Integrated Planning and Analytics:

The Analyst View

The BARC Score report for Integrated Planning and Analytics focuses on the market for integrated planning and analytics products and portfolios. It analyzes the strengths and challenges of all the leading vendors as well as several smaller vendors that often have less visibility, but still offer outstanding value to their customers.

Every vendor is evaluated on two dimensions: “Portfolio Capabilities” and “Market Execution”. Each represents one axis on the Score. These two dimensions include the following sub-criteria.

In general, portfolio capabilities reflect functional and architectural criteria. A special emphasis is placed on the integration of planning and analytics functionality within the vendors’ product portfolios. An additional and important evaluation criterion is ease of use for business users.

Market execution takes into account the vendors’ product, sales and marketing strategies as well as certain organizational, financial and geographical considerations.

There are two separate categories of inclusion criteria for this BARC Score: the first is associated with a vendor’s products and portfolios and the other is linked to the financial results relating to those products.

Functionality for planning (including write-back of planning data to a central database and other advanced planning features such as workflows, forecasting and simulation) is the “entrance ticket” to be evaluated in this BARC Score.

Moreover, a vendor has to supply additional functionality for all four of the following analytics technologies in a solution not merely focused on one industry or use case:

- Formatted Reporting

- Ad Hoc Query and Reporting

- Analysis

- Dashboarding

In addition, a vendor has to generate a minimum of 20 million EUR in revenue per year (software revenue) with the evaluated product set in this BARC Score, spread across Europe and at least two additional geographies. The product set must have a significant number of implementations and license or subscription revenues worldwide across different geographies to be considered as global.

BARC Score – Integrated Planning and Analytics

Score Regions

Dominators are vendors that drive both technology and market adoption in a highly influential manner. They possess both a broad portfolio of market-leading and dominating products with a strong brand as well as a robust commercial prowess through best-in-class sales and marketing programs, an extensive ecosystem of business partners and alliances, and a rock-solid financial position. Dominators are considered a contender in virtually every planned implementation.

Market Leaders are well established vendors that drive strong market adoption, supported by technology innovation and strategic acquisitions and by leveraging robust account management and a solid track record. Their portfolio enjoys high brand awareness in the market and covers an extensive range of technologies and services with only few gaps. Market Leaders typically have a large market share, making them a viable contender in almost all implementation scenarios.

Challengers come in various shapes and sizes. They can be large vendors tapping into a new market by acquisition and pushing their way in with force, small innovative companies with a promising portfolio but limited sales and marketing resources, or vendors that attempt to disrupt a market with a new technology approach or different business model.

Specialists are usually smaller vendors with a portfolio focused on a specific market segment. They can be either limited in their technical capabilities by concentrating on certain features and functions, or they may only focus on select geographic regions rather than the global marketplace.

Entrants are usually startups with limited reach and visibility in the market. Their product capabilities are incomplete when compared to competitors, and their long-term market potential is still unproven.