IBM Planning Analytics

IBM is one of the world’s largest vendors of IT hardware, software and services. The company has a global workforce of more than 280,000 employees and is active in over 170 countries.

IBM offers a comprehensive portfolio of on-premises and cloud analytics and performance management solutions (in particular, for planning and financial consolidation). The core offerings consist of IBM Cognos Analytics with Watson and IBM Planning Analytics with Watson. For financial consolidation and regulatory reporting, IBM Cognos Controller is part of the performance management portfolio.

IBM Planning Analytics – the vendor’s strategic enterprise planning product – is a core element in IBM’s performance management portfolio and has been on the market since the 1980s. Due to its rich functionality for planning and OLAP analysis, and its underlying in-memory TM1 technology, the product plays a strategic role for IBM. Planning Analytics is available in both classical on-premises and cloud versions. Essentially, Planning Analytics is a high-performance, multidimensional, in-memory database for budgeting, planning and forecasting with Excel and web front ends. The product is targeted at business power users for building all kinds of applications (planning, analytics, strategy management). Therefore, it has no dominant focus on any one particular topic (financials, sales, HR, etc.). In the latest versions of Planning Analytics, IBM has strengthened the product’s web client with a modernized user interface and user experience, extended charting options and visualizations, workflow and predictive forecasting capabilities as well as enhancing its web-based modeling environment.

IBM Planning Analytics is used by enterprises of all sizes and industry sectors, and is suitable for creating data entry screens for multiple sub-budgets, consolidating their results, and running simple to highly complex calculations. Hundreds of solutions – from small-scale departmental tools to installations with thousands of users – have been implemented worldwide. Resources and expertise for Planning Analytics are widespread.

Cognos Analytics, IBM’s enterprise BI and analytics platform, provides functionality for dashboards, pixel-perfect reporting, stories, data modeling and analysis in a unified web-based user experience. It combines ease of use with elaborate governance features in an end-to-end platform. The product can be used in large-scale scenarios supporting the needs of many concurrent users as well as large data volumes. IBM has infused NLQ, automated insights and intent-driven modeling and has invested in automation and ML capabilities across data modeling, dashboards, data exploration and an analytics chat assistant. The AI assistant allows users to explore data by asking natural language questions and by receiving insightful answers with a presentation-ready dashboard or report.

User & Use Cases

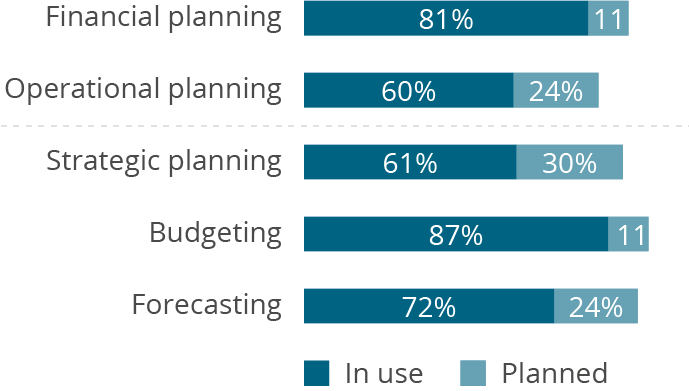

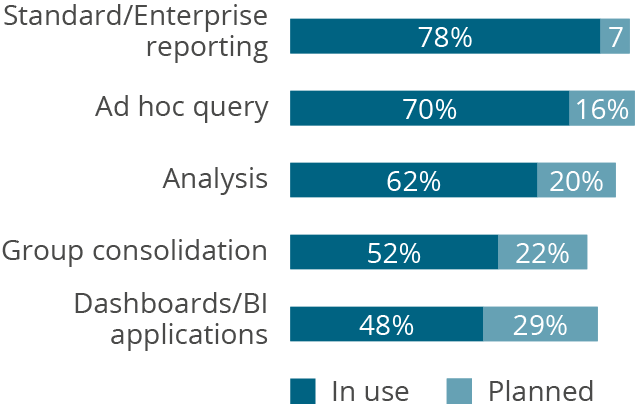

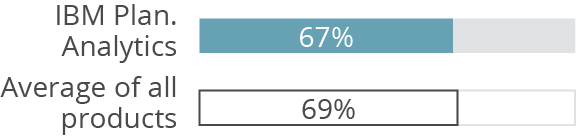

67 percent of IBM Planning Analytics users are planning users – just around the survey average of 69 percent – reflecting the fact that IBM Planning Analytics is essentially a planning platform with complementary BI and analytics functionality. This is also born out in its typical use cases. Customers leverage IBM Planning Analytics mainly for financial planning (81 percent) but also operational planning (60 percent). Here, planning takes place at different aggregation levels. IBM Planning Analytics is used for budgeting (87 percent), forecasting (72 percent) and strategic planning (61 percent). Besides planning, customers mainly use it for standard/enterprise reporting (78 percent), ad hoc query (70 percent) and analysis (62 percent). Many respondents also plan to use it for strategic planning (30 percent), dashboards/BI applications (29 percent), forecasting (24 percent) and operational planning (24 percent) in the future.

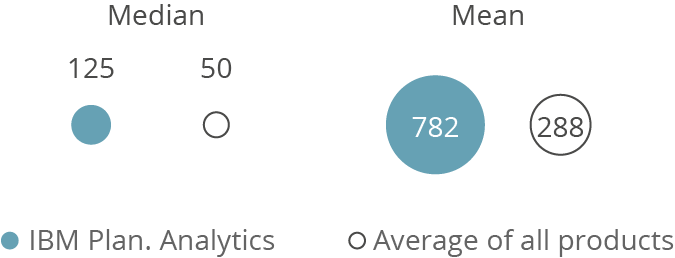

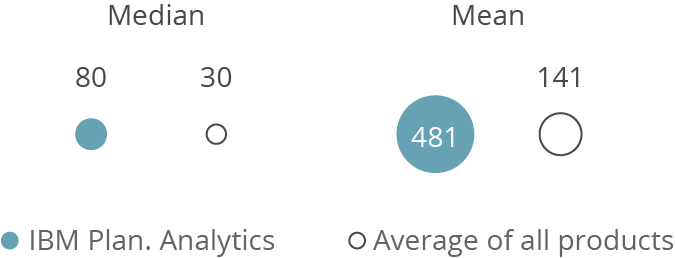

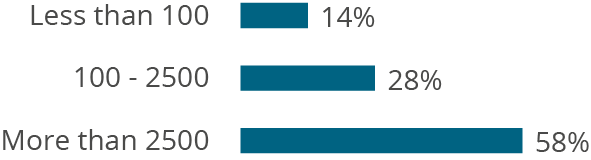

IBM Planning Analytics targets mid-sized and large companies across all industries. 58 percent of our sample of IBM Planning Analytics customers come from large companies (more than 2,500 employees) with a median of 125 users (including 80 using planning functionality), but the mean of 782 users (481 for planning) indicates there are also several significantly larger implementations.

Current vs. planned use (planning use cases)

N=71

Current vs. planned use (besides planning)

N=71

Total number of users per company

N=72

Planning users per company

N=72

Percentage of employees using IBM Planning Analytics

N=72

Planning users (as a percentage of all users)

N=72

Company size (number of employees)

N=72

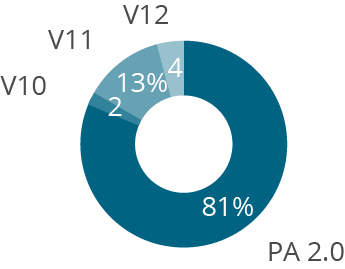

Versions used

N=48

Want to see the whole picture?

BARC’s Vendor Performance Summary contains an overview of The Planning Survey results based on feedback from IBM Planning Analytics users, accompanied by expert analyst commentary.

Contact us to purchase the Vendor Performance Summary- Register for a free sample Vendor Performance Summary download

- If you have any questions, feel free to contact us