The Planning Survey 23 is the ninth edition of BARC’s annual report on the planning software market. Our research is primarily based on a sample of 1,321 survey responses from software users and consultants around the world, providing detailed user feedback on 19 of the leading planning, budgeting and forecasting software solutions on the market.

Our user survey covers issues ranging from the selection and purchase of software through to deployment and use, including questions about the success of planning software projects, the usability of each product and problems encountered.

The following links provide more detail on our survey methodology, the survey sample and the way in which we categorize and rate planning products:

Components of The Planning Survey

The findings from The Planning Survey 23 are published across several bite-size documents (see below). These documents do not need to be read in sequence. The Results and the Vendor Performance Summaries can be read independently.

BARC also provides the raw data via a web-based tool – The Planning Survey Analyzer – enabling users to carry out their own analysis of the survey results.

The Results

The Analyzer

Vendor Performance Summaries

Sample & Methodology

Much of the value of The Planning Survey 23 lies in its large, well-distributed and unbiased sample of survey responses. This section describes the characteristics of the people who took part in the study.

The Planning Survey 23 has the largest sample of any survey of planning, budgeting and forecasting software users available on the market. As far as possible, we only draw conclusions from sub-samples containing at least 30 data points.

Our data cleansing rules are thorough and involve a number of different tests. All fraudulent or suspect data that purports to be from genuine planning software users is removed.

Sample size and make-up

Many thousands of people around the world were invited to take part in The Planning Survey 23, using dozens of email lists, magazines and websites.

A summary of the online data collected is shown in the table, with the total number of responses removed also displayed.

The number of responses is divided between users, consultants and vendors. As in previous years, vendors answered a different set of questions to those answered by users (and consultants answering on behalf of users).

| Responses removed from the samples | Responses |

| Total responses | 1,321 |

| Removed during data cleansing | -146 |

| Total answering questions | 1,175 |

| Total responses analyzed | Responses |

| Users | 897 |

| Consultants | 149 |

| All users | 1,046 |

| Vendors/Resellers | 79 |

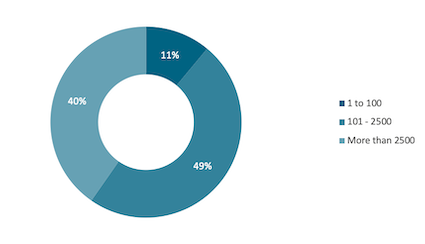

Organization sizes by headcount

Planning, budgeting and forecasting products are mostly found in large organizations, a fact reflected in the high percentage of responses we received from users in companies with more than 2,500 employees.

However, the level of responses from small organizations has been catching up over the years.

The split between respondents from small and large enterprises is well balanced this year.

Frequency of employee count in respondent organization (n= 851)

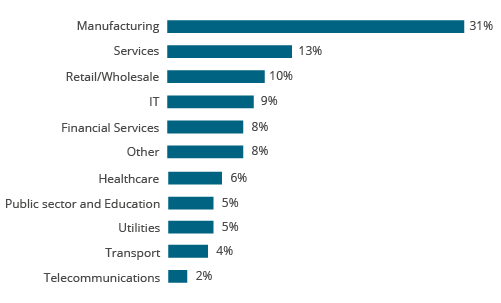

Vertical markets

The chart on the right shows the breakdown of survey responses by industry sector. It only includes respondents who answered product-related questions in the survey (i.e., users and consultants).

Manufacturing comes out on top – as it has in previous years – with 31% of the sample.

Respondents analyzed by industry (n=1,095)

Planning Products in The Planning Survey

We require at least 30 user reviews for the survey results of any planning product to be analyzed in detail. 19 planning, budgeting and forecasting tools reached this threshold in this year’s Planning Survey.

When grouping and describing the planning solutions featured in The Planning Survey, we do not always follow the naming conventions the vendors use to the letter. The names we use are sometimes abbreviated and are not always the official product names used by the vendors at the time of publication.

We asked respondents explicitly about their experiences with products from a predefined list, with the option to nominate other products. This list is updated each year and is based on the sample size of the products in the previous year, as well including new entrants to the planning market.

Where respondents said they were using an ‘other’ product, but from the context it was clear that they were actually using one of the listed products, we reclassified their data accordingly.

The table to the right shows the planning products included in our detailed analysis.

| Product | Number of reviews |

| Anaplan | 30 |

| Board | 50 |

| CCH Tagetik | 37 |

| CoPlanner | 35 |

| Corporate Planning | 32 |

| IBM Planning Analytics | 72 |

| Jedox | 43 |

| LucaNet | 42 |

| macs Software | 40 |

| OneStream | 32 |

| Oracle Cloud EPM | 30 |

| Planful | 40 |

| Prophix | 29 |

| SAP Analytics Cloud | 33 |

| SAP BPC | 40 |

| Serviceware Performance | 30 |

| Unit4 FP&A | 32 |

| Valsight | 37 |

| Workday Adaptive Planning | 31 |

Want to rate your BI and analytics software?

Share your experience in the world‘s largest and most comprehensive survey of BI software users

Take part in The BI & Analytics SurveyThe Peer Groups

A range of different planning and budgeting tools is featured in The Planning Survey 23, so we use peer groups to help identify competing products. This approach ensures we make fair and useful comparisons of planning tools that are likely to compete, for the benefit of readers and vendors alike.

The peer groups are defined each year by BARC analysts using their experience and judgment.

The segmentation of the peer groups is based on four key factors:

- Focus – Is the product focused on and typically used for planning, budgeting and forecasting (e.g., finance, sales & operations, HR, etc.), financial consolidation or business intelligence and analytics?

- Specialization – Is the vendor a performance management/planning specialist or a business software generalist, offering a broader portfolio of enterprise software for a variety of business requirements?

- Usage scenario – Is the product typically used in midsize/departmental implementations or large/enterprise-wide implementations?

- Geographical presence – Does the vendor have a global reach and offer its products worldwide?

Peer groups serve as a guide to the reader to help make the products easier to understand and to show why individual products return such disparate results. They are not intended to be a judgment of the quality of the products. Most products appear in more than one peer group.

Besides planning and performance management, BI and analytics-focused products also target use cases such as reporting, dashboarding, (ad hoc) analysis and advanced analytics.

Business software generalists have a broad product portfolio including most (or all) types of enterprise software for a variety of business requirements (e.g., ERP).

Besides planning, financial consolidation-focused products have a strong focus on group consolidation and close processes. Typically, these products are standardized applications that offer built-in financial intelligence with predefined business rules for financial management as well as supporting use cases such as financial planning (P&L, balance sheet, cash flow).

Global vendors have a truly global sales and marketing reach. They are present worldwide, and their products are used all around the world.

Products in this peer group are typically (but not exclusively) used in large scenarios and/or enterprise-wide implementations with a large number of users.

Products in this peer group are typically (but not exclusively) used in small and midsize scenarios and/or departmental implementations with a moderate number of users.

Performance management specialists are software vendors who focus solely on performance management and/or planning. Often, they have just one product in their portfolio.

Planning-focused products support planning, budgeting and forecasting processes. Since The Planning Survey is focused on exactly this use case, this peer group includes all of the products featured in the survey. Planning-focused products often offer flexibility to model a wide range of individual sub-plans (financial, operational, strategic, etc.) but may also include predefined planning solutions designed for particular applications.

The KPIs

The KPIs are designed to help the reader spot winners and losers in The Planning Survey 23 using well-designed dashboards packed with concise information. There is a set of 27 normalized KPIs (which we refer to as ‘root’ KPIs) for each of the 19 products, as well as 6 aggregated KPIs based on aggregations of various combinations of ‘root’ KPIs.

A set of KPIs has been calculated for each of the eight peer groups. The values are normalized according to the whole sample.

The KPIs all follow these simple rules:

- Only measures that have a clear good/bad trend are used as the basis for KPIs.

- KPIs may be based on one or more measures from The Planning Survey.

- Only products with samples of at least 15 – 30 (depending on the KPI) for each of the questions that feeds into the KPI are included.

- For quantitative data, KPIs are converted to a scale of 1 to 10 (worst to best).

- A linear min-max transformation is applied, which preserves the order of, and the relative distance between, products‘ scores.

- In some instances, adjustments are made to account for extreme outliers.

KPIs are only calculated if the samples have at least 15 – 30 data points (this varies depending on the KPI) and if the KPI in question is applicable to a product. Therefore some products do not have a full set of root KPIs.

Our methodology document describes all the KPIs and calculation methods in detail. See our methodology PDF.

| Aggregated KPIs | Root KPIs |

| Business Value | Business Benefits |

| Project Success | |

| Project Length | |

| Competitiveness | Considered for Purchase |

| Competitive Win Rate | |

| Customer Satisfaction | Product Satisfaction |

| Vendor Support | |

| Implementer Support | |

| Price to Value | |

| Recommendation | |

| Sales Experience | |

| Functionality | Predefined Connectors |

| Data Integration | |

| Planning Content | |

| Planning Functionality | |

| Workflow | |

| Forecasting | |

| Simulation | |

| Reporting/Analysis | |

| Financial Consolidation | |

| Customer Experience | Self-Service |

| Ease of Use | |

| Flexibility | |

| Performance Satisfaction | |

| Innovation | Cloud Planning |

| Driver-Based Planning | |

| Predictive Planning |