CP Corporate Planning AG (CP) is a software vendor and consultancy based in Hamburg, Germany. The company was founded in 1989 and currently has 70-100 employees. CP has offices in Germany, Austria, Switzerland, the Netherlands and the UK. In 2021, CP was acquired by proALPHA, a globally active ERP provider focused on SMEs in manufacturing, wholesale and other sectors. proALPHA employs over 2,000 people worldwide and more than 8,000 customers use its software.

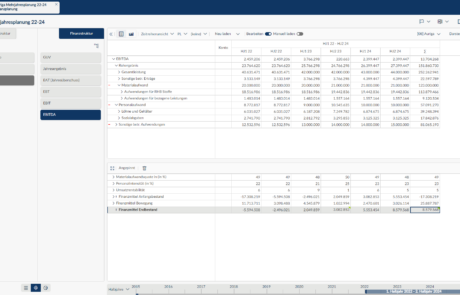

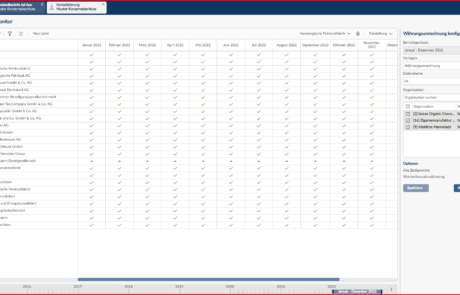

CP offers Corporate Planner, an integrated solution for operational management, financial planning, sales management, financial consolidation, HR management and management reporting. All modules have a common UI and are based on an integrated database in Microsoft SQL Server. More than 1,500 customers worldwide use various modules of Corporate Planner, the majority of whom are located in the DACH region. Corporate Planner and its individual modules are available in an on-premises version and in the cloud leveraging Microsoft Azure. In 2020, CP acquired Hi-Chart and has integrated its comprehensive reporting and visualization capabilities into Corporate Planner but also continues to market Hi-Chart as a standalone product for IBCS-compliant reporting.

Corporate Planner is targeted at business departments and especially the finance department. The solution can be deployed as a single desktop application and as an enterprise solution for CPM integrating multiple departments or companies within a group. Across its entire customer base, Corporate Planner is used by an average of 20-30 users per installation, but it also supports installations with significantly larger numbers of users.

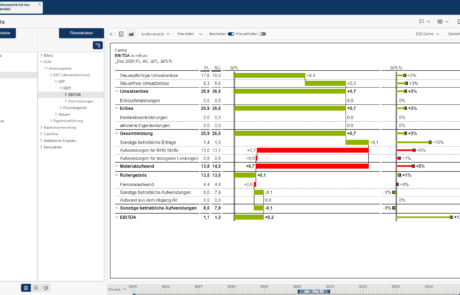

Corporate Planner’s strengths include its no-code customization and configuration via wizards that enable a high level of self-service without consulting support. It has comprehensive, out-of-the-box planning functionality and predefined reports and analyses that support business power users in a variety of tasks. The product provides centralized top-down planning, decentralized bottom-up planning as well as a combination of both approaches. The vendor does not focus on any one particular planning topic (financials, sales, HR, etc.) or industry. Furthermore, Corporate Planner Cons supports the management consolidation and legal consolidation of plan data as well as actuals (IDW PS 880 certified) at group level in compliance with all the relevant accounting standards (e.g., HGB and IAS/IFRS).

Besides CPM capabilities, Corporate Planner offers standard and ad hoc reporting with various report types and simpler options for the display of and navigation in data. Moreover, a library of predefined business analyses is available, which users can run directly on existing data. For more advanced graphical display of data, Hi-Chart’s comprehensive chart library is integrated in Corporate Planner’s reporting studio in the web client to visualize data in an IBCS-compliant way. An extensive template library supports users in selecting the right visualizations for data. For dashboarding and analytics, CP has a strategic partnership with Qlik. Qlik Sense’s web client is fully integrated in Corporate Planner’s web client to display dashboards and analyses created with the Qlik product. Predefined dashboard templates are available (e.g., for finance, HR, etc.). Microsoft Power BI is also integrated in Corporate Planner’s web client to display and select charts. For general third-party access to Corporate Planner data, the product’s Connectivity BI can be used to export data into separate databases.

User & Use Cases

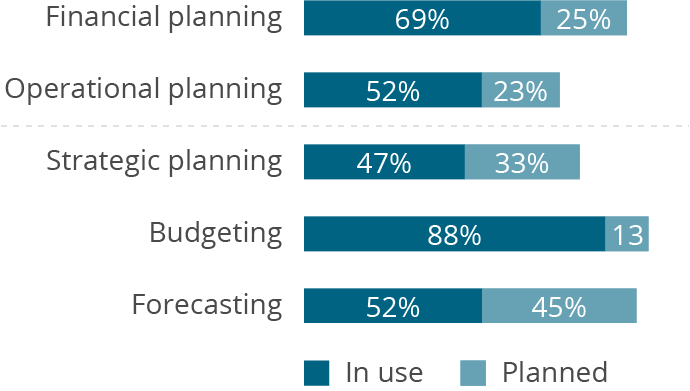

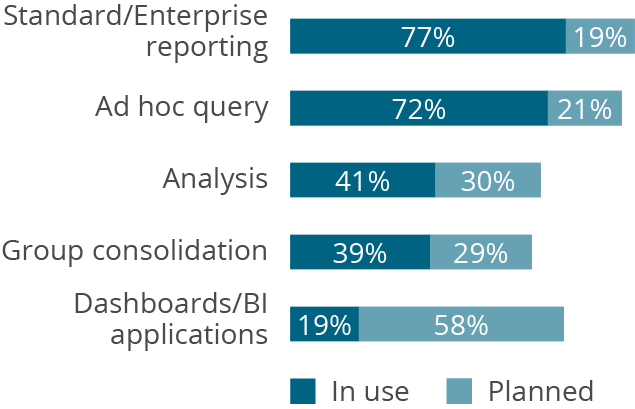

72 percent of Corporate Planner users are planning users – slightly above the survey average of 69 percent – reflecting the fact that Corporate Planner is essentially a planning platform with supplementary BI and analytics capabilities. This is also born out in its typical use cases. Customers leverage Corporate Planner mainly for financial planning (69 percent) but also operational planning (52 percent). Here, planning takes place at different aggregation levels. Corporate Planner is used for budgeting (88 percent), forecasting (52 percent) and strategic planning (47 percent). Besides planning, customers mainly use it for standard/enterprise reporting (77 percent) and ad hoc query (72 percent). Many respondents also plan to use it for dashboards/BI applications (58 percent), forecasting (45 percent) and strategic planning (33 percent) in the future.

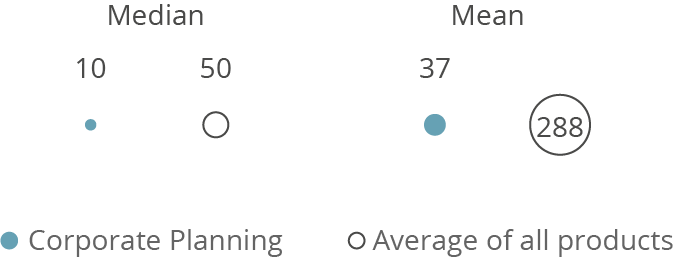

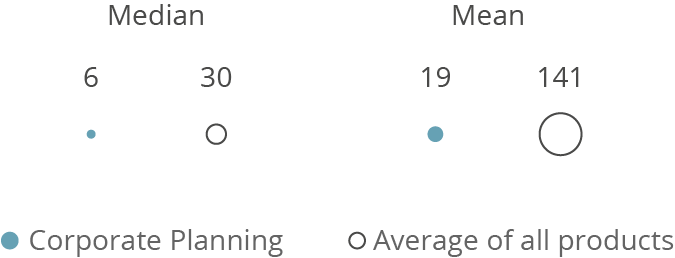

Corporate Planner targets small and mid-sized companies across all industries, predominantly in the DACH region. 66 percent of our sample of Corporate Planner customers come from mid-sized companies (100-2,500 employees) with a median of 10 users (including 6 using planning functionality), but the mean of 37 users (19 for planning) indicates there are also some larger implementations.

Current vs. planned use (planning use cases)

N=32

Current vs. planned use (besides planning)

N=31

Total number of users per company

N=32

Planning users per company

N=32

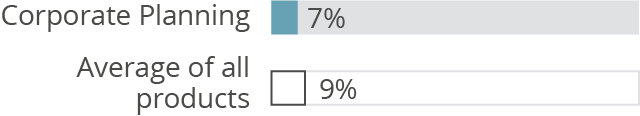

Percentage of employees using Corporate Planner

N=32

Planning users (as a percentage of all users)

N=32

Company size (number of employees)

N=32

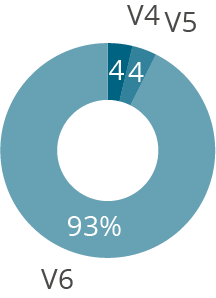

Versions used

N=27

Summary of Corporate Planner highlights

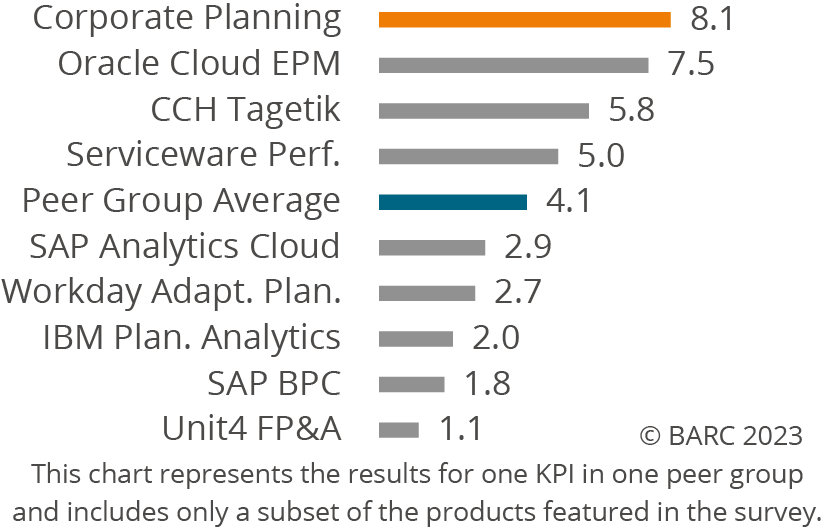

Planning Content – Top-ranked

Peer group: Business Software Generalists

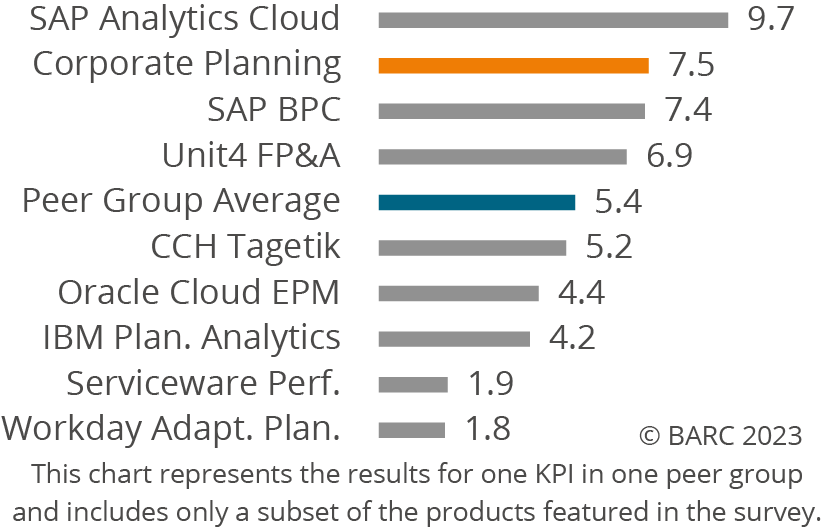

Predefined Connectors – Leader

Peer group: Business Software Generalists

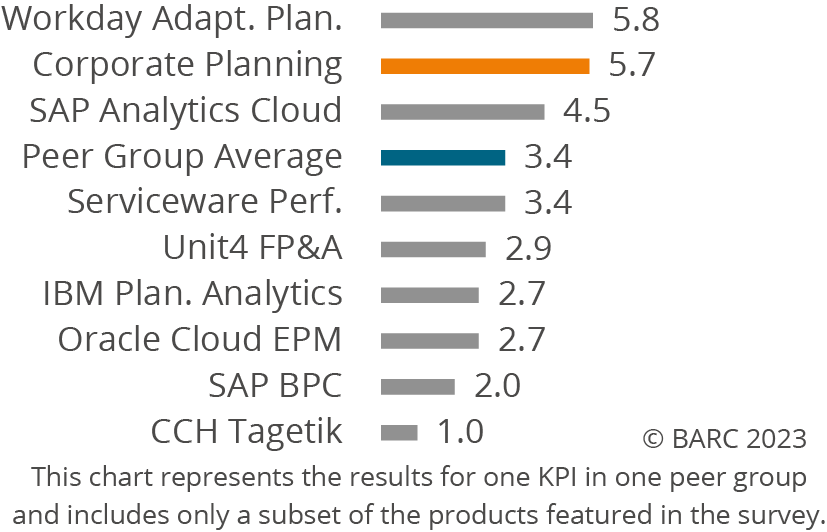

Project Length – Leader

Peer group: Business Software Generalists

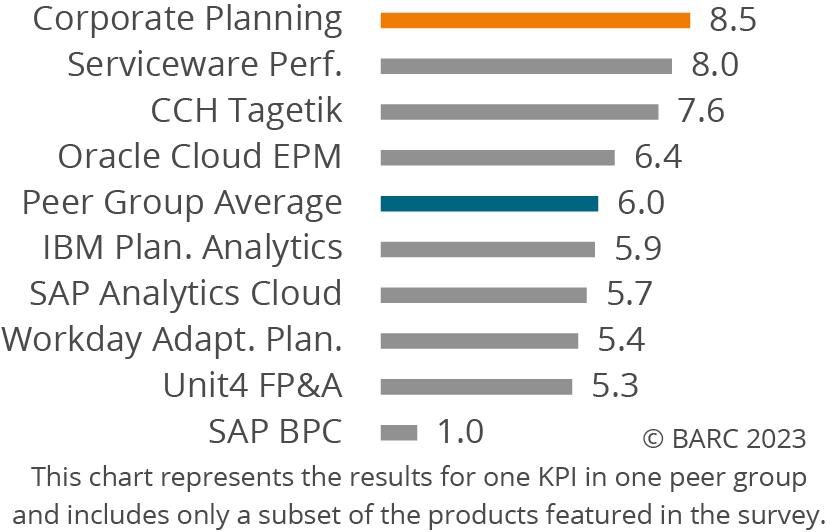

Project Success – Top-ranked

Peer group: Business Software Generalists

Want to see the whole picture?

BARC’s Vendor Performance Summary contains an overview of The Planning Survey results based on feedback from Corporate Planner users, accompanied by expert analyst commentary.

Contact us to purchase the Vendor Performance Summary- Register for a free sample Vendor Performance Summary download

- If you have any questions, feel free to contact us