Anaplan

Anaplan is a cloud-native enterprise software-as-a-service (SaaS) vendor headquartered in San Francisco, USA. The company currently employs more than 2,000 people worldwide. Several major investors have financed Anaplan’s growth and global expansion. In 2022, Anaplan was acquired for approximately $10.4 billion by Thoma Bravo, a leading software investment firm.

The Anaplan platform began its development in 2006 and was officially released in 2008. The company’s name is a combination of analytics and planning. The product represents a new generation of planning and performance management products developed with state-of-the-art technologies on a modern software architecture. Anaplan is a purely cloud-based platform using a proprietary in-memory database to store data (patented Hyperblock technology). The goal behind Anaplan’s development was to create a new planning platform with the ease of use and flexibility of a spreadsheet and the scalability of an enterprise planning product in the cloud.

Anaplan targets corporate finance and operational business departments to connect financial and operational plans to support multiple use cases across finance, sales and marketing, HR and workforce and supply chain in large enterprises and groups worldwide. The goal is to support customers with a modern, integrated platform by joining people together with plans and data. In addition to horizontal use cases, the platform offers industry-specific solutions across a number of verticals such as consumer goods & retail, banking & insurance, telecoms and life sciences. Anaplan’s partner ecosystem, which includes consulting firms and systems integrators, offers a number of such solutions built on the platform. In 2022, Anaplan acquired the application division of its partner Vuealta, including prebuilt applications for demand planning, supply planning, inventory planning, and sales and operations planning / integrated business planning (S&OP/IBP) running on the Anaplan platform.

Anaplan has more than 2,000 customers worldwide. Implementations range from double-digit to several thousand users per installation. To sell and particularly to implement Anaplan, the vendor has an expansive global ecosystem of more than 175 partners including technology partners with supplementary technical capabilities.

Anaplan provides flexible functionality for centralized top-down as well as decentralized bottom-up planning approaches. With its ‘connected planning’ platform approach, customers can create various planning models on different aggregation levels (strategic and operational planning) for an integrated enterprise planning approach (including financial planning). The vendor’s in-memory database supports detailed planning models with data up to transactional level (articles, stores, employees, etc.). In addition to the ‘Partner Solutions Showcase’, Anaplan offers hundreds of prebuilt apps, solutions, templates and accelerators via the vendor’s App Hub site (e.g., for financial planning, sales performance management and demand management).

User & Use Cases

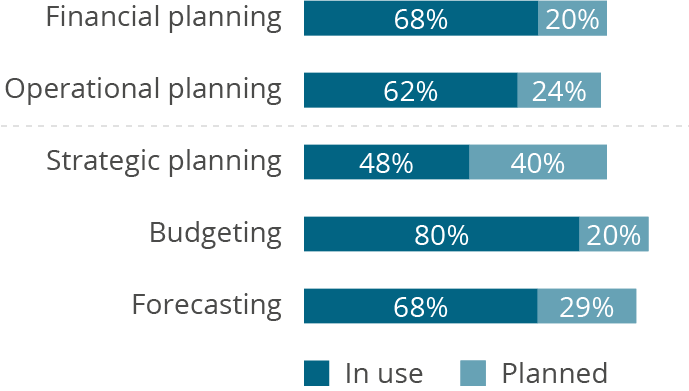

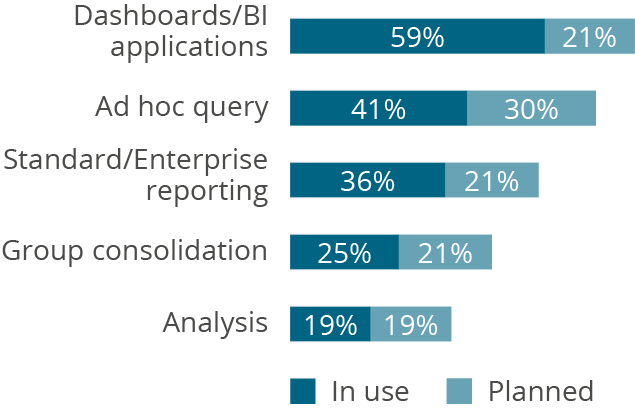

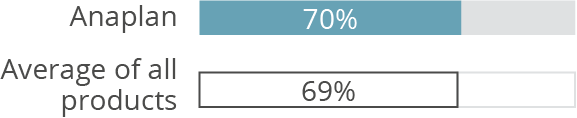

70 percent of Anaplan users are planning users – slightly above the survey average of 69 percent – reflecting the fact that Anaplan is essentially a planning platform rather than a BI and analytics tool. This is also demonstrated by its typical use cases. Customers leverage Anaplan mainly for financial planning (68 percent) but also operational planning (62 percent). Here, planning takes place at different aggregation levels. Anaplan is used for budgeting (80 percent), forecasting (68 percent) and strategic planning (48 percent). Besides planning, customers also use Anaplan for dashboards/BI applications (59 percent) and ad hoc query (41 percent). Many respondents plan to use it for strategic planning (40 percent), ad hoc query (30 percent) and forecasting (29 percent) in the future.

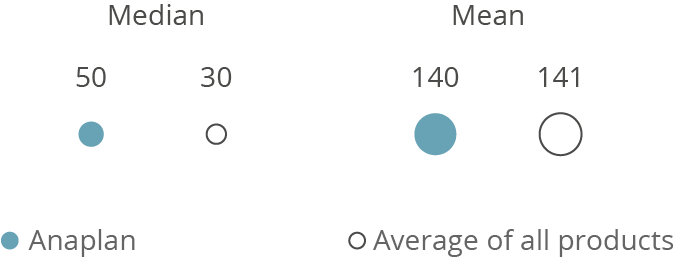

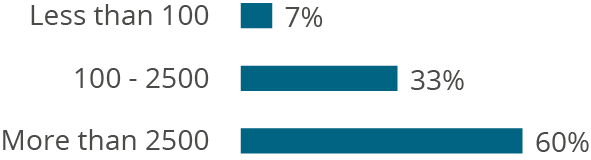

Anaplan targets large and mid-sized companies across all industries. 60 percent of our sample of Anaplan customers come from large companies (more than 2,500 employees) with a median of 92 users (including 50 using planning functionality), but the mean of 207 users (140 for planning) indicates there are also several larger implementations.

Current vs. planned use (planning use cases)

N=29

Current vs. planned use (besides planning)

N=30

Total number of users per company

N=30

Planning users per company

N=30

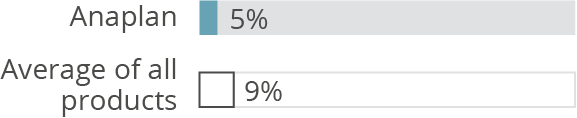

Percentage of employees using Anaplan

N=28

Planning users (as a percentage of all users)

N=28

Company size (number of employees)

N=30

Versions used

N=30

Want to see the whole picture?

BARC’s Vendor Performance Summary contains an overview of The Planning Survey results based on feedback from Anaplan users, accompanied by expert analyst commentary.

Contact us to purchase the Vendor Performance Summary- Register for a free sample Vendor Performance Summary download

- If you have any questions, feel free to contact us