Prophix

Founded in 1987, Prophix began as a software distributor implementing financial applications before it released its own CPM software in the year 2000. In 2021, Prophix received significant investment from Hg to accelerate and scale growth and fund further development. In the first instance of inorganic growth in the company’s history, Prophix acquired Sigma Conso, a Belgian financial performance management (FPM) specialist, in late 2021. Prophix now has more than 500 employees and over 2,600 active customers worldwide, covering all company sizes and industries. In addition to its market presence and continuous growth in North America, Prophix is increasingly winning customers outside its core market (e.g., in Europe).

Prophix’s own product is a unified, business-user-focused corporate performance management (CPM) solution that delivers insights into and automates finance, operations and business performance processes. The product covers planning, budgeting and forecasting, reporting and analytics. Data and metadata in Prophix is stored in Microsoft SQL Server. Sigma Conso has its strengths in FPM, offering software for financial consolidation and close, management reporting and intercompany reconciliation as well as specialty solutions for IFRS 16 and iXBRL. Prophix’s future product strategy focuses on integrating Prophix and Sigma Conso more closely into the unified Prophix Financial Performance Platform with four applications: Financial Planning & Analysis, Reporting & Analytics, Financial Consolidation and Intercompany Management. The platform targets business departments (e.g., finance and accounting) in midsize companies across all industries and is available in the Amazon cloud (AWS).

Prophix is a flexible no-code solution that does not confine itself to any one single planning topic (financials, sales, HR, etc.). The product can be used to create individual planning applications with capabilities for top-down and bottom-up planning including workflow functions to control planning processes. In general, Prophix contains little predefined business content (e.g., for specific industry verticals). However, a prebuilt Prophix solution is available for the construction industry and more industry-specific content will become available in the future. Partners also offer prebuilt content for certain topics and industries.

Besides planning, Prophix provides capabilities for BI and analytics. Standard reporting in a formatted and print-oriented way is supported, as are ad hoc queries based on OLAP methodologies (drill functionality, slice and dice, pivoting, etc.). For visualizing data (e.g., in management cockpits or dashboards), standard business graphics as well as more advanced chart types are available. Reports, like planning templates, are created in a user-friendly, Excel-like environment. An HTML5 web client and Microsoft Office add-ins are available as front ends to enter plan data or to work with reports, analyses and dashboards. In addition, for those customers following a Microsoft strategy, Prophix data sets can be pushed to Power BI for more advanced dashboarding, data visualization and analytics.

With product enhancements such as report, contribution and chart insights, anomaly detection and a virtual task assistant, Prophix continues to simplify and automate use for business users by leveraging AI, ML and natural language processing techniques.

User & Use Cases

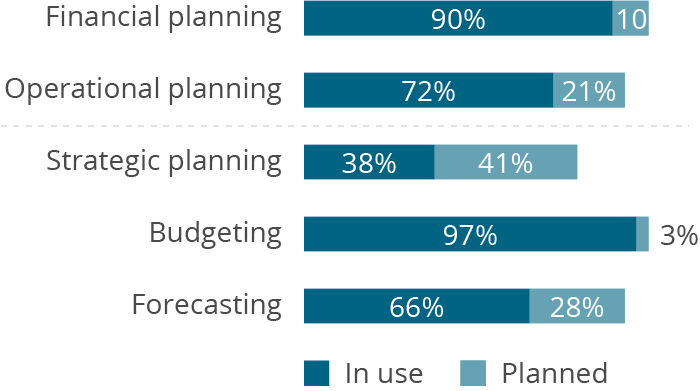

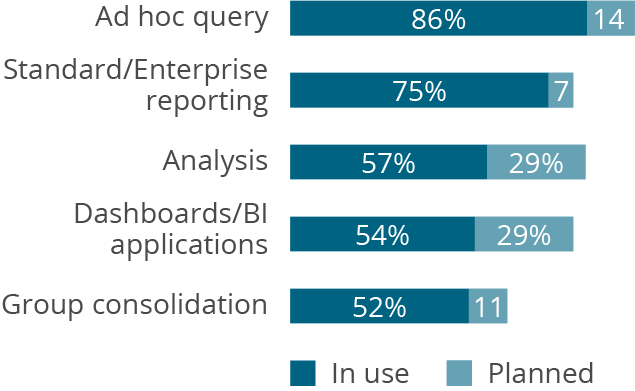

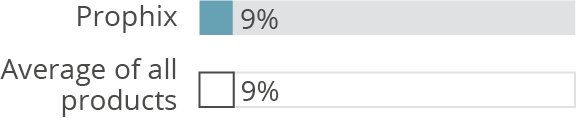

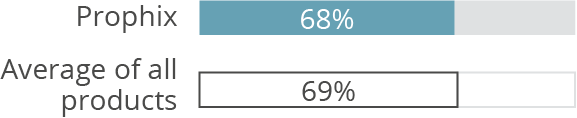

68 percent of Prophix users are planning users – just around the survey average of 69 percent – reflecting the fact that Prophix is essentially an integrated planning and CPM tool with strong planning but also BI and analytics functionality. This is also born out in its typical use cases. Customers leverage Prophix mainly for financial planning (90 percent) but also operational planning (72 percent). Here, planning takes place at different aggregation levels. Prophix is used for budgeting (97 percent), forecasting (66 percent) and strategic planning (38 percent). Besides planning, customers mainly use it for ad hoc query (86 percent), standard/enterprise reporting (75 percent) and analysis (57 percent). Many respondents also plan to use it for strategic planning (41 percent), dashboards/BI applications (29 percent) and forecasting (28 percent) in the future.

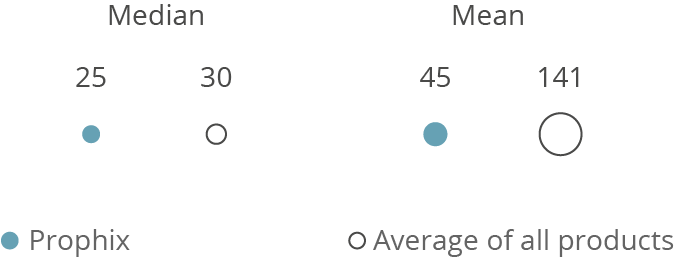

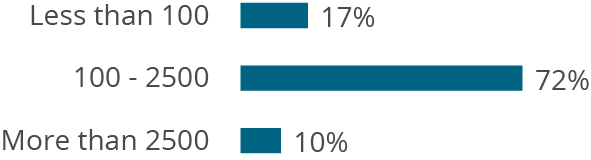

Prophix targets mid-sized companies across all industries. 72 percent of our sample of Prophix customers come from mid-sized companies (100-2,500 employees) with a median of 25 users (including 25 using planning functionality), but the mean of 61 users (45 for planning) indicates there are also some larger implementations.

Current vs. planned use (planning use cases)

N=29

Current vs. planned use (besides planning)

N=29

Total number of users per company

N=29

Planning users per company

N=29

Percentage of employees using Prophix

N=29

Planning users (as a percentage of all users)

N=29

Company size (number of employees)

N=29

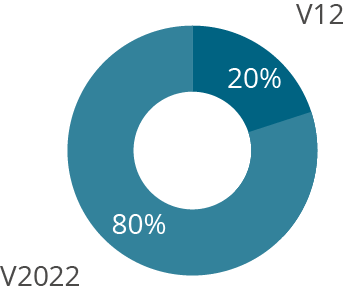

Versions used

N=25

Want to see the whole picture?

BARC’s Vendor Performance Summary contains an overview of The Planning Survey results based on feedback from Prophix users, accompanied by expert analyst commentary.

Contact us to purchase the Vendor Performance Summary- Register for a free sample Vendor Performance Summary download

- If you have any questions, feel free to contact us