SAP BO BI

SAP was founded in Germany in 1972 as a business applications company. The vendor now employs more than 112,000 people worldwide and had a turnover of €30.9 billion in FY2022. SAP is one of the largest business software vendors in the world.

The vendor’s data and analytics portfolio is based on the strategic SAP Business Technology Platform (BTP), which provides cloud-based data, analytics, application integration and extension services across all SAP products. The platform is technologically built on SAP HANA Cloud, a modernized cloud-based version of SAP HANA, the vendor’s in-memory database.

Although the vendor focuses on cloud, its current front-end analytics portfolio encompasses cloud-based and on-premises solutions for business intelligence, augmented and predictive analytics, as well as planning. The cloud-based SAP Analytics Cloud and the on-premises SAP BusinessObjects BI are SAP’s core offerings for BI and analytics. Predictive analytics functionality for business users is covered in SAP Analytics Cloud while more extensive functions for data science are made available in SAP BTP.

SAP Analytics Cloud is SAP’s strategic cloud analytics offering. It combines analytics capabilities such as data discovery and visualization, enterprise planning and augmented analytics into an integrated all-in-one offering. The SAP BusinessObjects (BO) Business Intelligence (BI) Suite (SAP BO BI) is part of SAP’s on-premises BI portfolio, which incorporates various end-user business intelligence tools with a moderate level of integration. The suite contains some strong individual products for reporting as well as several clients for various types of analysis. It also offers good capabilities for building customized guided BI applications that can be published to the web or mobile devices.

SAP has set BusinessObjects BI – including all related components (SAP Crystal Reports, SAP BusinessObjects Web Intelligence, SAP Analysis for Microsoft Office and SAP Lumira) – on maintenance by ensuring support (for version 4.3) until 2027 (or extended support until 2030). However, in 2022, SAP published a new statement of direction that shed a slightly confusing light on the future of the suite. While confirming the maintenance dates above, SAP also announced plans to release a SAP BO BI 2024 platform but canceled this later. In April 2023, in a new statement of direction, SAP announced a new “2025” version, which will be supported until at least the end of 2029 for mainstream maintenance, and 2031 for priority 1 support.

User & Use Cases

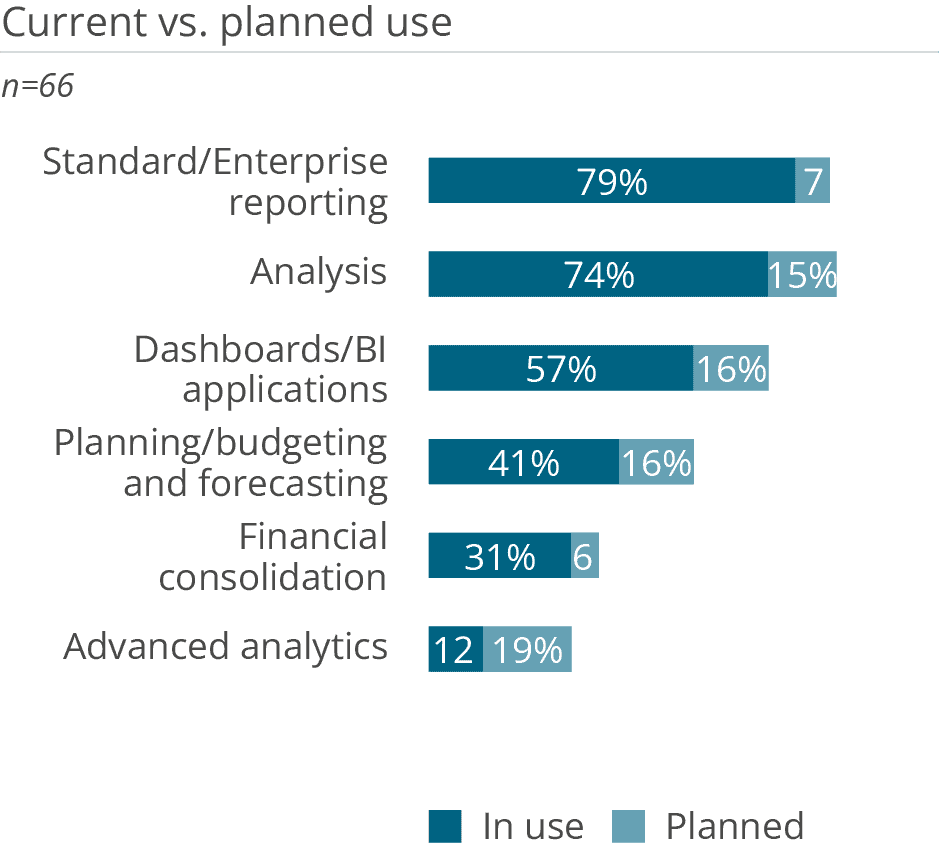

The SAP BO BI platform consists of several different products. In this year’s survey, half of the responses received came from SAP Analysis for Office users (51 percent) and 35 percent came from Web Intelligence users. This is reflected in the typical usage scenarios: 79 percent use the suite for reporting and 74 percent for analysis – probably mainly users of Analysis for Office.

Detailed data shows that many of the implementations date back more than 2 years. Of course, this also means that relatively few new customers have opted for SAP BO BI in the last two years – especially compared to other products. Against the background that SAP Analytics Cloud – a new, modern, cloud-based solution – is also available, this is of course easy to understand.

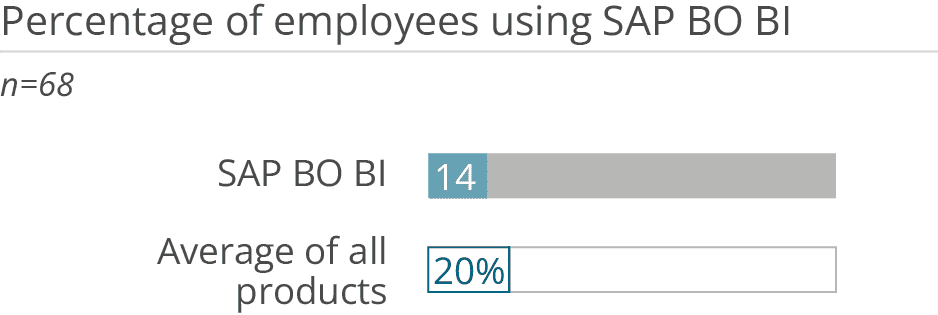

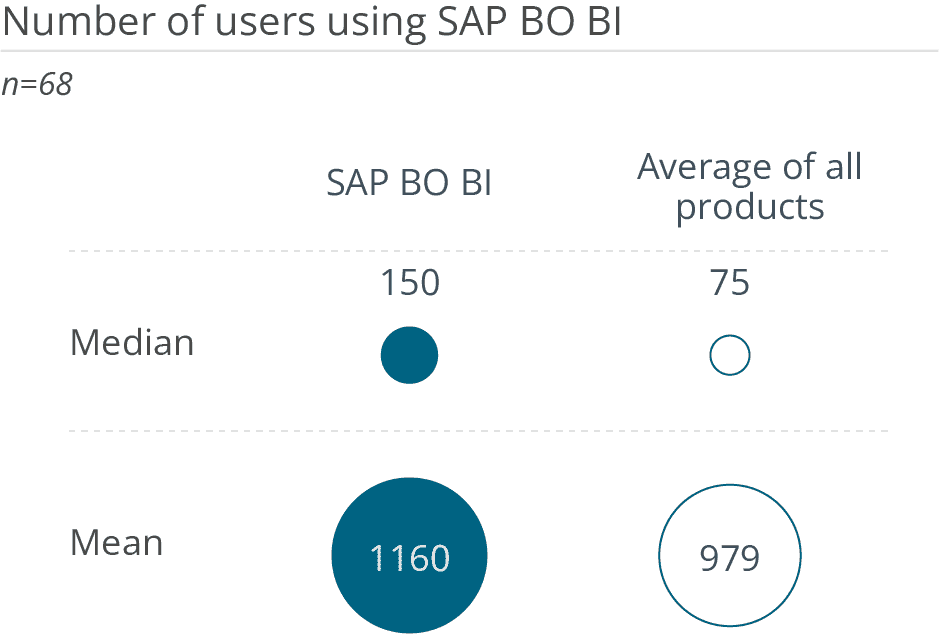

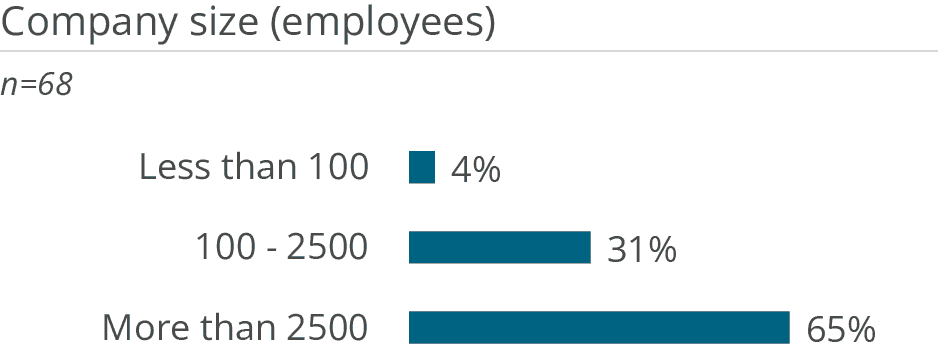

The suite is mostly used by large companies with a median of 5,000 people. Customers typically work with large data sets (3,237 GB on average). The median number of users is moderate at 150, but the mean of 1,160 clearly indicates that there are much larger implementations out there. Although typical user numbers are high, the percentage of employees using the product is rather low at 14 percent. This shows that the solution is likely used in specific departments rather than company-wide in most cases.

Almost every SAP BO BI customer has used the product in the finance department (97 percent). Other departments that have made significant use of SAP BO BI include sales (74 percent) and management (71 percent).

Want to see the whole picture?

BARC’s Vendor Performance Summary contains an overview of The BI Survey results based on feedback from SAP BO BI users, accompanied by expert analyst commentary.

Contact us to purchase the Vendor Performance Summary- Register for a free sample Vendor Performance Summary download

- If you have any questions, feel free to contact us