MyReport

MyReport SAS – formerly known as Report One – is a privately held French BI software company with approximately 95 employees and 5,000 customers. Since its foundation in 2001, which was also the year its BI product MyReport was first released, the company has expanded its presence to four offices spread across France.

The vendor’s current focus is primarily on the French market. More than 200 value-added resellers (VARs) distribute MyReport, mainly in France. The majority of sales and implementations are done by partners.

MyReport focuses on small and medium-sized businesses (SMB). The vendor claims that these organizations cannot afford the mostly expensive and technically complex software which often requires a great deal of IT-oriented resources to administer. Therefore, the vendor has sought to build an affordable and easy-to-use software that requires no code development and gives business users the ability to create BI content, from ETL to reporting and dashboarding.

MyReport is a BI solution integrated in the familiar Microsoft Excel spreadsheet environment and comes with a web-portal-based dashboarding module for distributing dynamic data to multiple users. The product’s philosophy is to enhance the analytical capabilities of Microsoft Excel and promote the reuse of data to spread controlled information across the organization. MyReport aims to help its customers to be more efficient at every step, from the integration of enterprise data all the way through to the consumption of reports, dashboards and analyses.

MyReport primarily addresses CEOs, CFOs, HR departments, sales managers and IT managers. Besides its Excel-oriented reporting, dashboarding and analysis functionality, the software offers an ETL module as well as data preparation features. The business-user-friendly software is designed to avoid scripting, regardless of business function, user type or use case. According to the vendor, users do not need scripting for data integration and preparation, or for calculating measures, designing reports and building visualizations. MyReport attaches great importance to progress and in enhancing the software. One focus area is the development of the web client, which offers a responsive interface for data visualization and dashboarding requirements.

MyReport has a simple and flexible license offering. Customers can either choose to buy licenses and pay an extra fee for maintenance or they can rent the software for an annual fee including maintenance costs. ‘Manager’ – the main type of full user license – covers a range of different user requirements. Access licenses through Excel and the Web are also available (Viewer or Center). The ‘Server’ license, which is required for data integration and sharing, is also charged either at a non-recurring or rental fee.

User & Use Cases

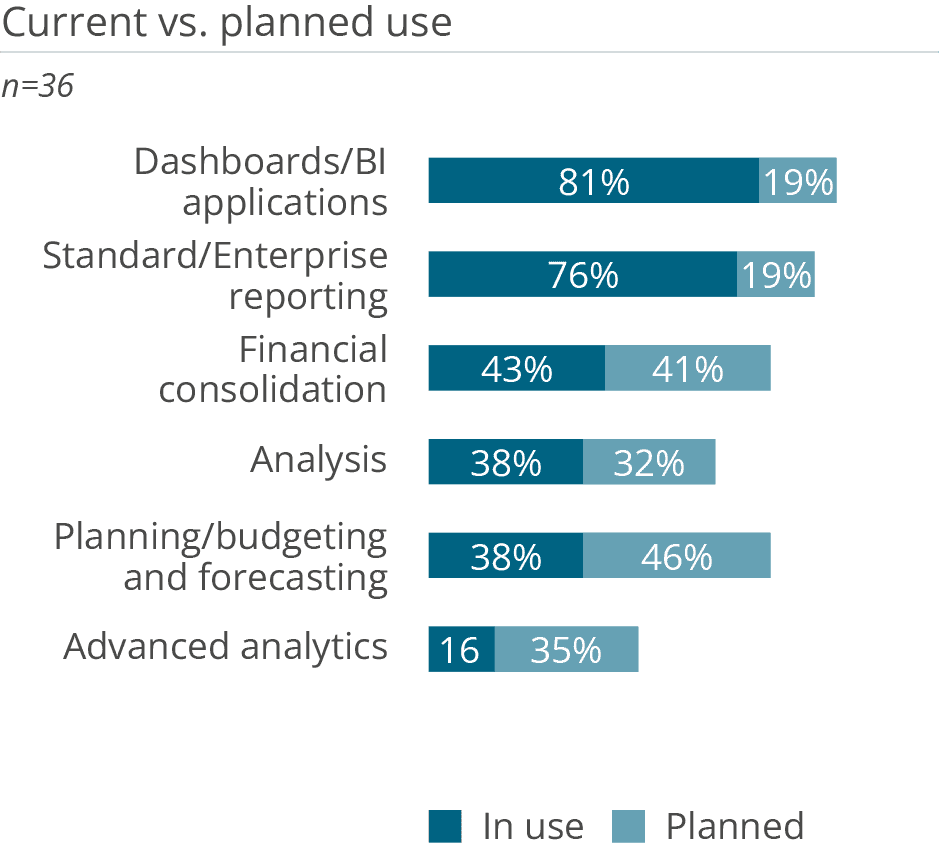

MyReport’s two distinct software modules are reflected in the two main use cases reported by users: dashboards (81 percent) and standard reporting (implemented by 76 percent of respondents). As almost all MyReport customers (92 percent) use the product in finance and controlling, it is unsurprising to see the software supporting use cases such as financial consolidation (43 percent), analysis (38 percent) and planning/budgeting and forecasting (38 percent) with its visualization features.

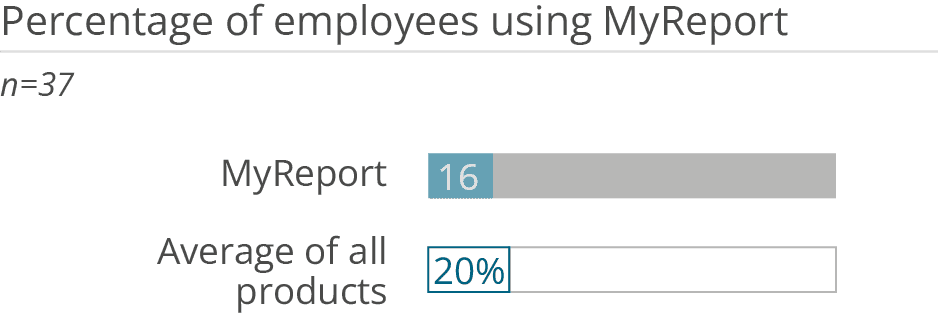

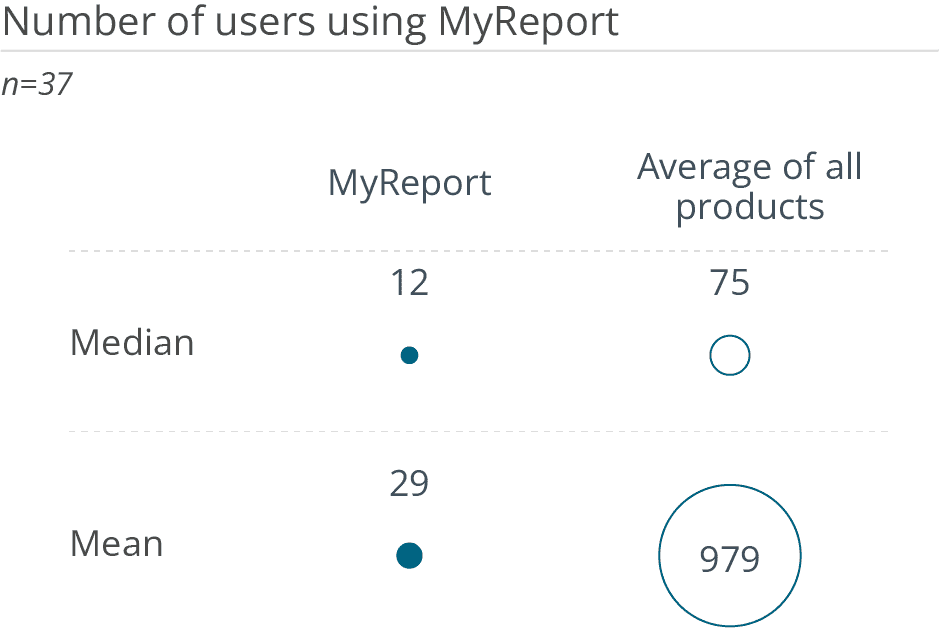

MyReport is a local vendor on the French market. All of the MyReport users taking part in this survey came from France. The vendor targets the SMB sector, represented by 41 percent of our sample. Although the majority of respondents are from mid-sized companies (57 percent), the median number of employees in companies using MyReport is 180.

As already mentioned, MyReport is heavily used in finance and controlling (92 percent), followed by sales with 70 percent. Only about half of the respondents use the product in management (51 percent) which reveals a tendency toward operational use.

Want to see the whole picture?

BARC’s Vendor Performance Summary contains an overview of The BI Survey results based on feedback from MyReport users, accompanied by expert analyst commentary.

Contact us to purchase the Vendor Performance Summary- Register for a free sample Vendor Performance Summary download

- If you have any questions, feel free to contact us