The vendor perspective

The BI vendors who responded to The BI & Analytics Survey answered a number of questions that revealed some differences between their perceptions and customers’ experiences. This article shows that vendors do not have a precise understanding of why customers chose their products, what problems their customers encounter and how customers use their products. It also finds that vendors have a relatively good understanding of their competition, although they generally underestimate the popularity of Microsoft Excel.

Relationship influence

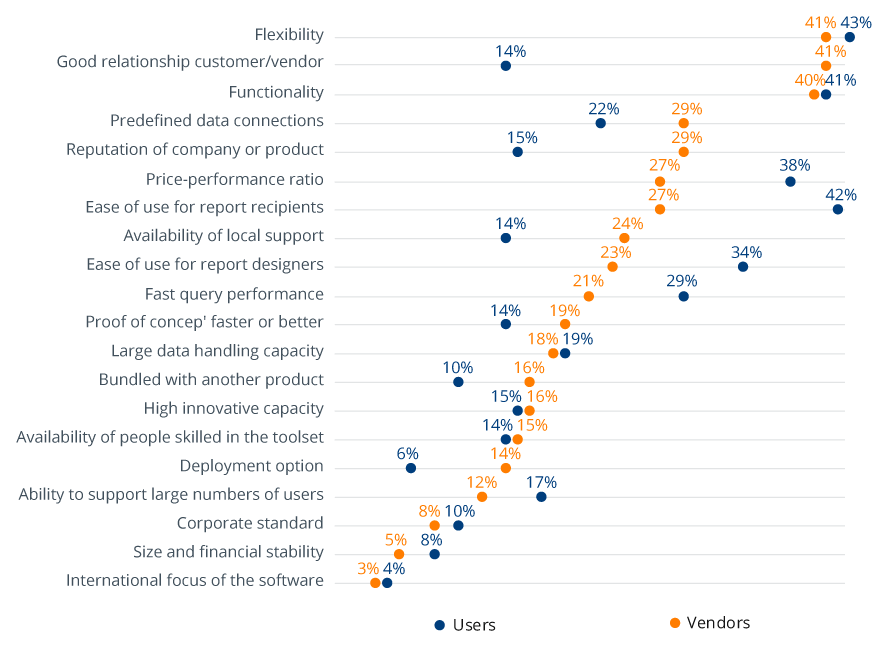

According to 41 percent of vendors, customers, at least in part, purchased their BI product because of a good relationship with the vendor. However, this is in contrast to customers’ reasons to buy, where only 14 percent said they bought a product because of a good vendor relationship. The disparity between the two may be caused by customers’ unwillingness to admit that a relationship played such a large part in their decision to buy. This theory is supported by the fact that just under a quarter (21 percent) said they conducted no competitive evaluation and an additional 16 percent said they only evaluated a single product.

Reasons to buy: user and vendor perspective (n=2520)

Reasons to buy: user and vendor perspective (n=2520)

Most common customer problem

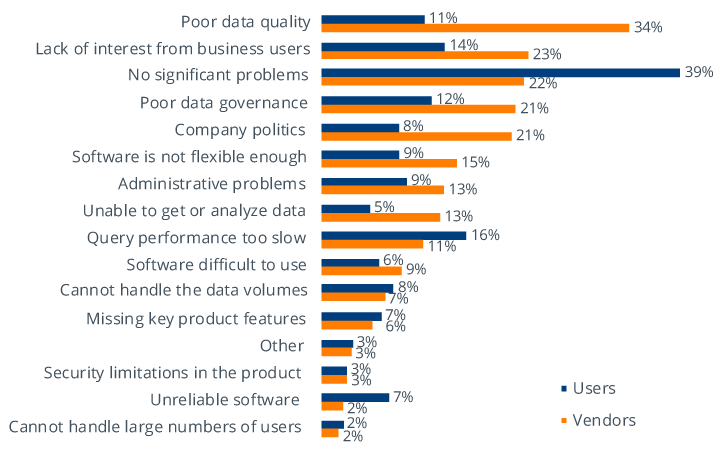

When asked to select the problems customers typically encounter, 34 percent of vendors chose poor data quality, making it the most selected issue. However, only a small portion of customers (11 percent) said this was a serious problem. The difference could be a result of vendors working closely with customers during implementation and data integration where data quality may be a prevalent issue. After deployment, though, customers should have fewer data quality issues going forward.

Usage problems: user and vendor perspective (n=2633)

In fact, over a third of customers (39 percent) said their business users have encountered no significant problems, while less than a quarter of vendors (22 percent) said their customers experienced no significant problems. This is because vendors probably have a more critical view of their product and customers’ experience.

Want to rate your BI and analytics software?

Share your experience in the world‘s largest and most comprehensive survey of BI software users

Take part in The BI & Analytics Survey

Customer use

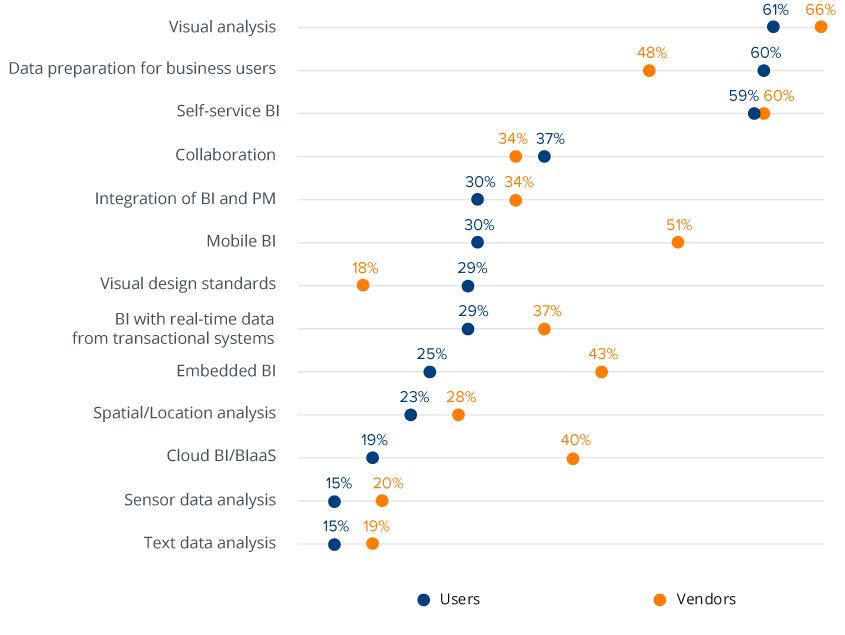

For the most part, vendors have a good understanding of what features customers use. However, there are a few features that vendors think customers use more often than they actually do. Mobile BI, cloud BI/BIaaS and embedded BI each have around a 20 percent difference between the vendor and customer answers.

Use of BI capabilities: user and vendor perspective (n=2703)

The difference may be explained by what the vendors are investing in or most focused on. Cloud, mobile and embedded BI are all at the forefront of BI technology, which may inflate a vendor’s perception of the level of customer usage.

BARC summary

On the whole, vendors understand their competition and agree with their customers. However, the vendor viewpoint does not always coincide with reality or with customers’ opinions. Vendors underestimate or forget to consider that Excel is one of the most widely used BI tools.

They also say that a good relationship is a reason that their product is purchased more frequently than customers say so. In addition, vendors say poor data quality is an issue much more often than customers do, and they overestimate the percentage of customers that use certain features.