Phocas

[The BI & Analytics Survey 23 results, not included in The BI & Analytics Survey 24] Phocas was founded in 2001 in the UK and is now a medium-sized company with full-service offices on three continents. The company has shown continuous growth over the last ten years and currently has around 2,500 customers. Phocas now has over 91 percent recurring subscription revenue, spread fairly evenly between the UK, Australia and North America. The self-funded company is still privately held by its founders.

Phocas software is designed for the manufacturing, distribution and retail industries. The company aims to provide its customers with data analytics solutions for the whole business, targeting users from different departments such as finance, sales, executives, IT and operations.

The company has five main products: Phocas Analytics is the core product focused on ad hoc query, reporting and dashboards. Phocas Financial Statements is a dynamic reporting and analysis product for financial information which extends Phocas Analytics. Phocas Budgeting and Forecasting is a business-user-oriented planning, budgeting and forecasting software. Phocas Rebates, which is built on top of Phocas Analytics, analyzes margin and performance, while the CRM application combines the analytical capabilities of Phocas BI with operational processes for sales and marketing (e.g., contact/campaign management).

Phocas’ consulting teams are experts in these areas and can help customers to set up data integration from ERP systems and expandable prebuilt data models. Although it has traditionally adopted a direct sales strategy, Phocas now relies on its partner business with its abundance of expertise and tool specialization. The partner network is expanding with a number of larger partners, especially in new distribution regions such as Asia and Europe.

Phocas offers prebuilt solutions and an easy-to-use, self-service tool that enables non-technical users to view and build dashboards or work in a spreadsheet-style environment when more detail and analytical capability is required. The product provides flexible analysis for business users, who can administer the tool themselves.

User & Use Cases

85 percent of this year’s Phocas respondents came from the vendor’s core verticals: 64 percent from retail/wholesale and 21 percent from manufacturing. Regionally, there was an even split from North America and the UK (44 percent each), 10 percent from APAC and 3 percent from the rest of the world.

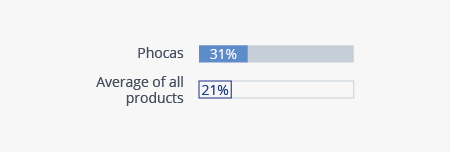

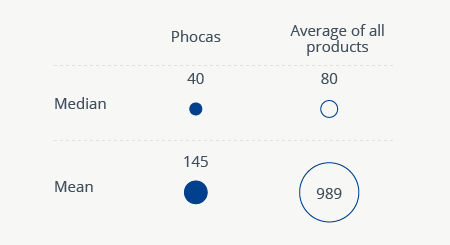

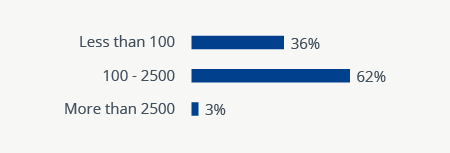

Phocas’ strongest footprint is in mid-sized companies, which is reflected in this year’s results: 62 percent came from companies with between 100 and 2,500 employees and 36 percent came from smaller companies. Overall, the median company size in terms of number of employees is 250. Customers reported a median of 145 users per company and a mean of 40. With an average of 31 percent of employees using BI (compared to the overall survey average of 21 percent), the product is more widely used in customer companies than most of its rivals.

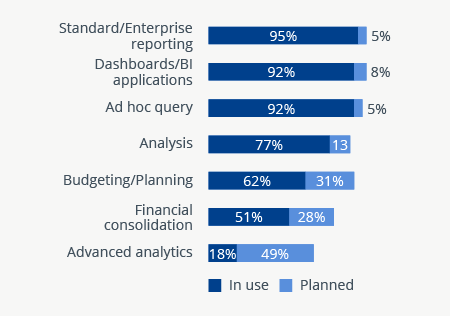

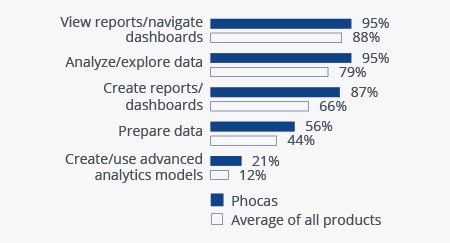

Over 90 percent of customers use Phocas for reporting, dashboards and ad hoc query. Its use in business departments dominates our demographic survey feedback. Almost all customers (95 percent) use the product in sales, 90 percent in management, followed by 67 percent in procurement and finance, and 62 percent in marketing.

Current vs. planned use

n=39

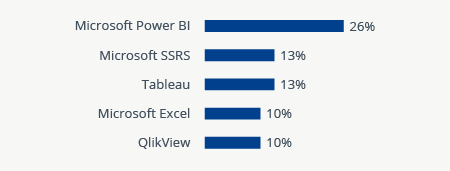

5 products most often evaluated in competition with Phocas

n=39

Percentage of employees using Phocas

n=39

Number of users using Phocas

n=39

Tasks carried out with Phocas by business users

n=39

Company size (number of employees)

n=39

Want to see the whole picture?

BARC’s Vendor Performance Summary contains an overview of The BI Survey results based on feedback from Phocas users, accompanied by expert analyst commentary.

Contact us to purchase the Vendor Performance Summary- Register for a free sample Vendor Performance Summary download

- If you have any questions, feel free to contact us