Microsoft Azure Synapse

Microsoft is the world’s largest software company by market capitalization. It was founded in 1975 and is headquartered in Redmond, Washington in the United States. It has become a household name primarily through the Windows operating system and Office application suite. Microsoft also has a vast range of enterprise software and cloud offerings, including its own database, browser, various servers and ERP solutions. In recent years, Microsoft has focused its business on cloud-based solutions such as Azure. AI and machine learning have also become important in product development.

Azure is Microsoft’s cloud platform. It offers over 200 different products and services on a global physical infrastructure consisting of data centers in over 60 countries. Azure has driven much of Microsoft’s recent growth and has become a successful strategic pillar for Microsoft, with revenue of more than 55 billion USD for the fiscal year ended June 2023, up more than 60 percent vs. the prior year. Microsoft is the second largest cloud provider in the world, behind Amazon Web Services (AWS). With total annual revenue of 212 billion USD, Microsoft enjoys strong business demand for its software and services.

Companies of all sizes and industries utilize Microsoft Azure. Products scale efficiently and components can be integrated easily with each other. In addition to Microsoft’s own services, certified partners offer a huge variety of solutions and services through the constantly growing Azure Marketplace. Microsoft Azure has a competitive and broad offering in the data and analytics space, ranging from PaaS solutions for data and big data management and analytics to multiple AI and machine learning offerings to specialized SaaS solutions, such as Azure Purview for data governance.

Over the years, Microsoft has developed several services on Azure to allow for the seamless implementation of data and analytics solutions. Power BI, its cloud-based reporting solution, has become a de facto standard for BI over the last 2-3 years while further services for data management, data lake storage, and data processing and transformation have been added over the years. To help customers simplify how they manage BI and AI/ML workloads, and to compete with converged data platforms such as Snowflake and Databricks, Microsoft combined all its relevant data and analytics services into Azure Synapse Analytics.

Azure Synapse Analytics combines Microsoft’s Data Lake Storage service with its own massively

parallel processing (MPP) SQL engine and Spark, the market-leading open-source data processing

engine. This combination enables the execution of enterprise data warehousing workloads as well as data science and machine learning workloads in one cohesive environment. The Azure Data Factory service for ETL is also included in Azure Synapse Analytics. Azure Data Factory offers code-based and code-free implementation of data pipelines for many source systems including several cloud services and ecosystems (e.g., SAP, GCP, AWS, Oracle and many others). It also integrates with Power BI – its own cloud-based reporting solution – which in turn has introduced features to seamlessly integrate

with Azure Synapse Analytics.

Microsoft Fabric, now in preview, aims to further simplify customer implementations by stitching together elements from Power BI, Azure Synapse and Azure Data Factory into a single SaaS environment. Microsoft Fabric supports use cases that span data engineering, data science, data warehousing, real-time analytics and BI. Microsoft also offers database templates for Azure Synapse Analytics. These include content for industry verticals and a large number of generic use cases. This move follows Microsoft’s 2020 acquisition of ADRM Software, a leading provider of large-scale industry data models, which are used by many large companies worldwide as information blueprints. This suggests that Microsoft is trying to go beyond providing pure base technologies with Azure Synapse Analytics by offering additional business content.

User & Use Cases

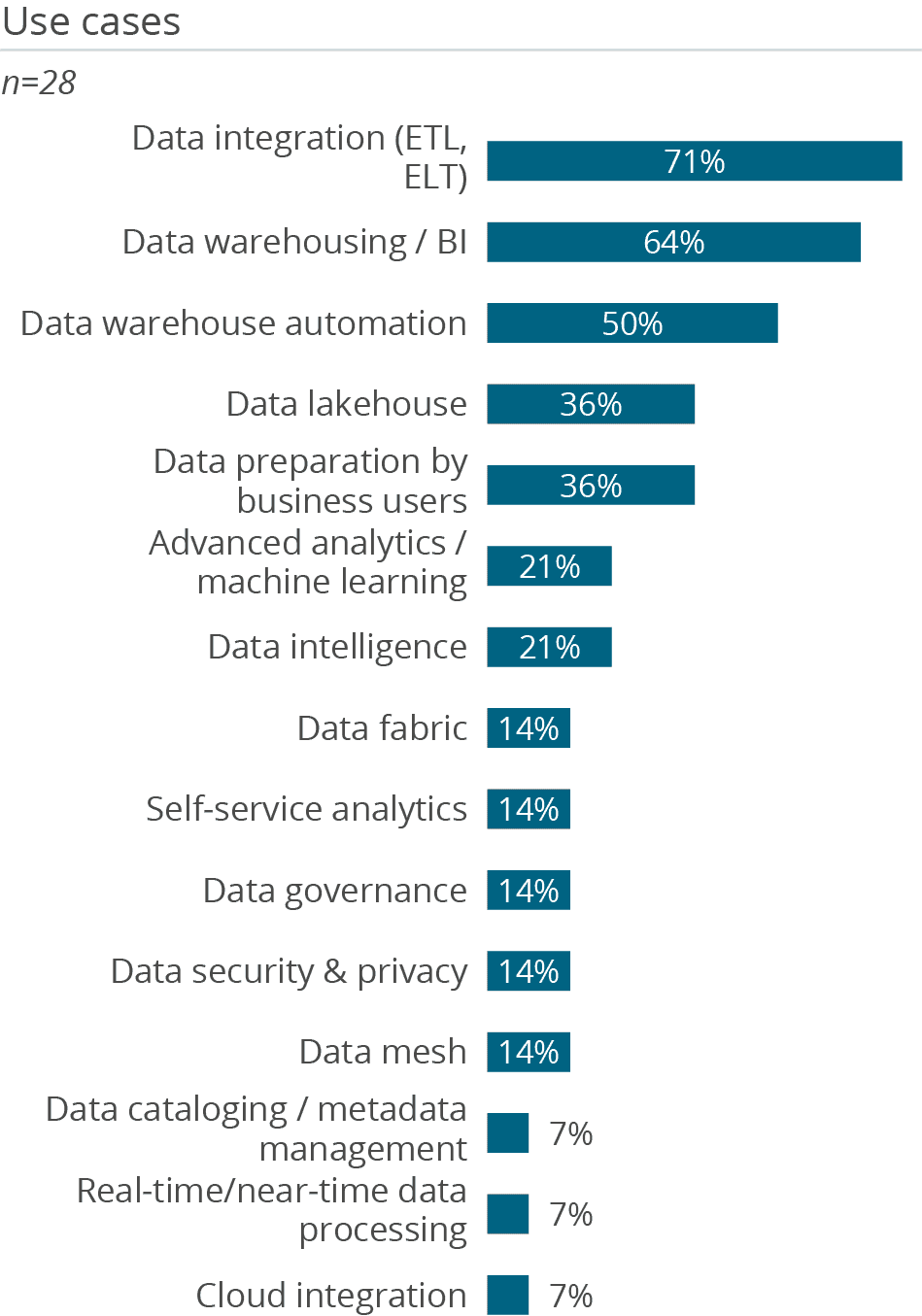

Customers use Azure Synapse Analytics predominantly for data integration (71 percent) and data warehousing/BI (64 percent), reflecting Microsoft’s long-standing position in these segments. Many also use the platform for data warehouse automation (50 percent), data lakehouse (36 percent) and data preparation by business users (36 percent). We can assume many companies use Power BI on top of Synapse given the popularity of data warehousing/BI projects. Notably, only 21 percent of respondents cited advanced analytics/machine learning as a use case for Synapse, a major drop from the top position of 71 percent last year. This suggests that Microsoft might have struggled lately in the AI/ML space. It also might reflect a shift in companies that participated in the survey this year compared with last year.

The majority of this year’s respondents (79 percent) work for mid-sized companies (100 to 2,500 employees), compared with 14 percent for large companies (more than 2,500 employees) and 7 percent for small companies (fewer than 100 employees). In contrast, last year only 43 percent worked for mid-sized companies, compared with 29 percent for large companies and 29 percent for small companies. It could be that mid-sized companies lack the resources (vs. large companies) or data science expertise (vs. startups) to experiment with AI/ML. If so, the shift to mid-sized respondents this year would contribute to the lower numbers of advanced analytics/ML use cases.

Nearly half of respondents (46 percent) use Synapse several times a day, and the rest (54 percent) use it several times a week. Half of them implement Synapse as software as a service (SaaS), another 36 percent implement it as a platform as a service (PaaS), and 14 percent have a hybrid implementation.

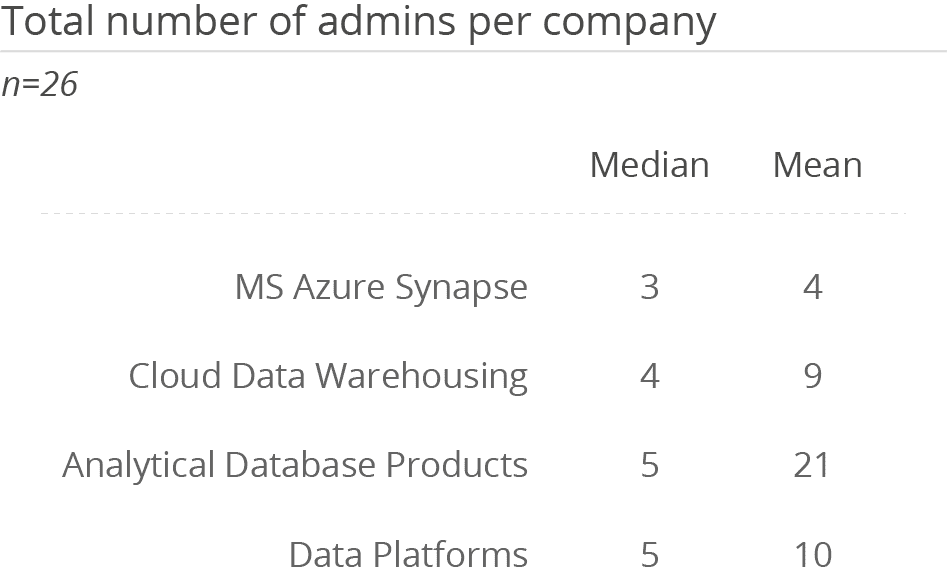

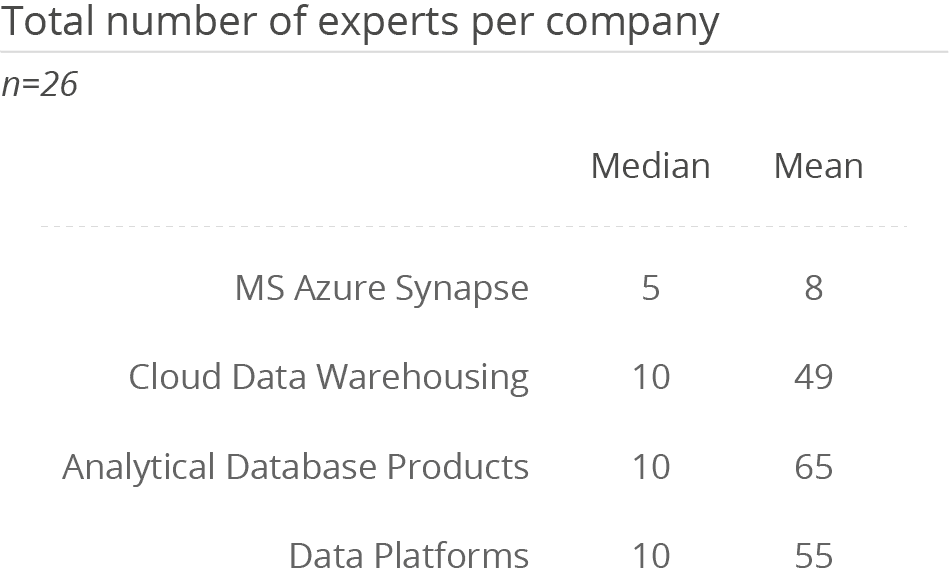

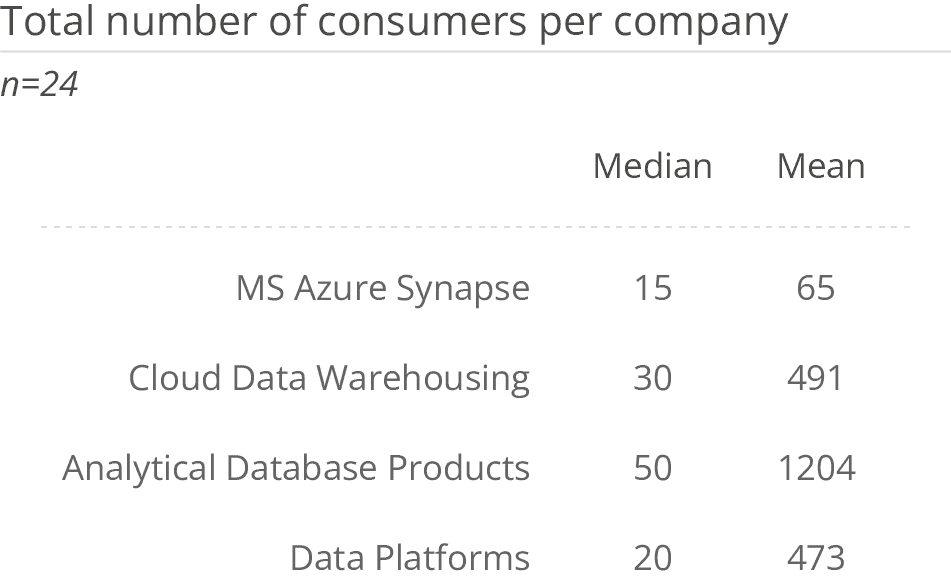

Despite Microsoft’s dominant overall market position, Synapse has a modest footprint within company environments. The mean of 8 Synapse experts per company trails all its peer groups (49 for Cloud Data Warehousing, 65 for Analytical Database Products, and 55 for Data Platforms). Similarly, the mean of 65 consumers per company trails all its peer groups as well (491 for Cloud Data Warehousing, 1,204 for Analytical Database Products, and 473 for Data Platforms). These numbers likely reflect the preponderance of respondents from mid-sized rather than large companies. They also might reflect a slow user migration from other Microsoft platforms such as Azure SQL Database or SQL Server to Synapse. To assist such migrations, Microsoft offers the Synapse Link managed service for continuous replication between those heritage platforms and Synapse.

Want to see the whole picture?

BARC’s Vendor Performance Summary contains an overview of The Data Management Survey results based on feedback from Microsoft Azure Synapse users, accompanied by expert analyst commentary.

Contact us to purchase the Vendor Performance Summary- Register for a free sample Vendor Performance Summary download

- If you have any questions, feel free to contact us