insightsoftware IDL

[The Planning Survey 22 results, not included in The Planning Survey 23] insightsoftware is a US-based global provider of solutions for the office of the CFO backed by private equity investors Hg, TA Associates and Genstar Capital. The company employs more than 2,000 people in over 40 locations worldwide and serves 30,000 customers with 500,000 active users. insightsoftware was formed in 2018 out of a merger of Hubble by insightsoftware.com and Global Software, Inc. The vendor’s rapid growth in recent years has been largely inorganic and driven by acquisitions. This strategy has resulted in a broad portfolio of more than 70 finance software solutions.

In late 2020, insightsoftware acquired IDL, a provider of software applications for financial performance management (FPM) offering professional expertise in all aspects of financial consolidation and close, planning, budgeting and forecasting, management and regulatory reporting and analysis. The company was founded in 1990 and has offices in Germany, Austria, Switzerland (DACH) and France. Today, insightsoftware sees IDL’s comprehensive FPM platform as a strategic element in its future success and expansion in the DACH region and bordering countries.

IDL’s FPM suite is an integrated platform and includes modules for financial consolidation and close (IDL Konsis), financial planning (IDL Forecast), operational planning, reporting and analysis (IDL Designer) as well as disclosure management (IDL Publisher). Furthermore, complementary solutions for financial filings and prebuilt content for specific industries and use cases (e.g., for professional sports and the public sector) are available. IDL solutions can either run on-premises, as cloud services (leveraging Microsoft Azure) or as hybrid scenarios (a combination of both cloud and on-premises). According to the vendor, more than 1,000 corporate groups currently use IDL solutions.

IDL supports planning scenarios for financial planning with IDL Forecast and for operational budgets with IDL Designer. IDL Forecast is targeted at business departments, which often belong to a group of companies. Company-wide financial results plans (balance sheet, P&L, cash flow) at subsidiary or group level can be created. Therefore, IDL Forecast provides a predefined financial (planning) data model with intertwined business rules, based on relational data storage. Thanks to its tight integration with IDL Konsis, it is possible to immediately consolidate plan data (or actuals) also taking into account planned intercompany allocations. IDL Konsis offers comprehensive capabilities for legal consolidation (IDW PS 880 certified) including intercompany reconciliation as well as management consolidation. Extensive predefined business rules for financial management are available as standard in the solution.

Operational planning scenarios other than financial planning (e.g., sales, HR, etc.) are supported with IDL Designer. Operational plans, which are based on multidimensional databases (Microsoft SQL Server Analysis Services or IBM TM1), are integrated with financial plans at data level with predefined routines for data integration using the ETL technologies available with the underlying databases (e.g., Microsoft SQL Server Integration Services, IBM TM1 Turbo Integrator). Besides its functionality for operational planning, IDL Designer is also the central component of IDL’s reporting platform and rounds out the portfolio with user-friendly, web-based functions to create ad hoc and standard reports, OLAP analyses and dashboards. Its modern tile interface and Windows look and feel provide a user-friendly environment for designing individual reports and analyses with custom layouts that can be organized in a report catalog.

User & Use Cases

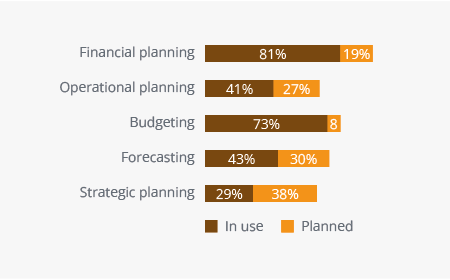

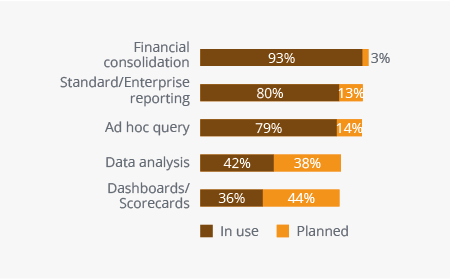

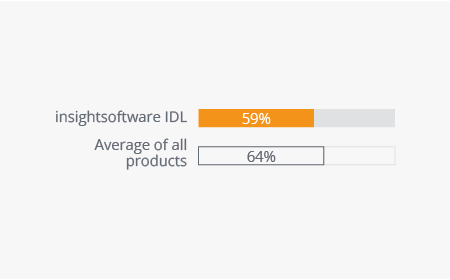

59 percent of IDL users are planning users – just below the survey average of 64 percent – reflecting the fact that it is essentially a financial consolidation tool with complementary planning and analytics functionality. This is also reflected in how the product is used. In terms of planning, customers leverage insightsoftware IDL mainly for financial planning (81 percent). Here, planning takes place at different aggregation levels. insightsoftware IDL is also heavily used for budgeting (73 percent). Besides planning, customers mainly use IDL for financial consolidation (93 percent), standard/enterprise reporting (80 percent) and ad hoc query (79 percent). Many also plan to use it for dashboards/scorecards (44 percent), data analysis (38 percent) and strategic planning (38 percent) in the future.

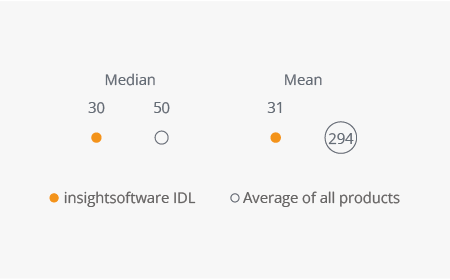

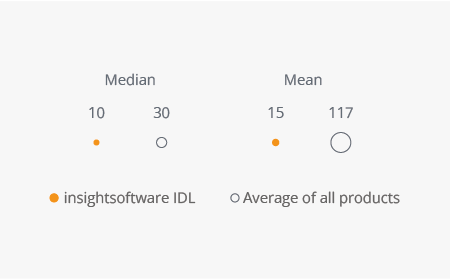

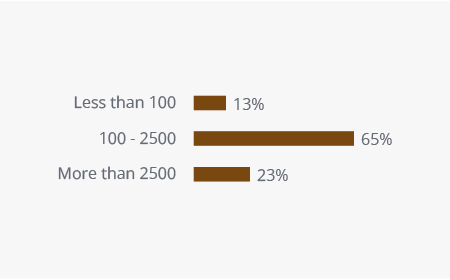

insightsoftware IDL targets mid-sized and large companies across all industries, predominantly in the DACH region. 65 percent of our sample of insightsoftware IDL customers come from mid-sized companies (100-2,500 employees) with a median of 30 users (including 10 using planning functionality), but the mean of 31 users (15 for planning) indicates there are also some larger implementations.

Current vs. planned use (planning use cases)

N=27

Current vs. planned use (besides planning)

N=31

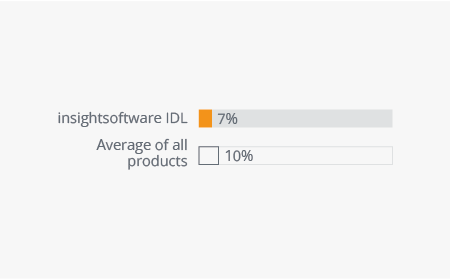

Percentage of employees using insightsoftware IDL

N=31

Planning users (as a percentage of all users)

N=31

Total number of users per company

N=31

Planning users per company

N=31

Company size (number of employees)

N=31

Want to see the whole picture?

BARC’s Vendor Performance Summary contains an overview of The Planning Survey results based on feedback from insightsoftware IDL users, accompanied by expert analyst commentary.

Contact us to purchase the Vendor Performance Summary- Register for a free sample Vendor Performance Summary download

- If you have any questions, feel free to contact us