Domo

[The BI & Analytics Survey 23 results, not included in The BI & Analytics Survey 24] Founded in 2010 in American Fork, Utah, Domo launched its first BI product in 2012 as a cloud-native, full-stack BI platform. After 2015, Domo quickly earned attention in the market and went public in June 2018. The vendor currently has over 960 employees that serve more than 2,300 customers.

Domo’s Business Cloud platform aims to supply customers with modern, end-to-end capabilities such as data integration and management, BI and analytics, and intelligent apps.

From the very beginning, Domo has focused on helping customers transform the way their business is managed by putting well governed and actionable data in the hands of everyone across the organization. Domo believes that access to all the relevant data is critical for business users to best understand what is going on in their domain, ask questions and take well-informed actions. Domo wants to provide business technology that is as easy-to-use and intuitive as mobile consumer applications, while offering enterprise-grade scalability, data governance and security features. Its Business Cloud platform aims to foster collaboration, efficient decision-making, increased productivity, and generate improved business results through faster and better leverage of data at scale.

The platform was designed to help IT and analytics experts as well as business users deliver value rapidly to the business by complementing their existing systems and infrastructure. Fragmented data silos and systems are connected in the unified Domo Data Warehouse to unlock value from data. One of Domo’s primary goals is to get data into the hands of all employees by simplifying data acquisition, delivery and consumption. Domo enables customers to connect to all their data by loading it to the internal data warehouse powered by its Adrenaline engine as well as in-place queries through a federated approach to publish live data into applications. Recently, the vendor optimized its multi-cloud query capabilities to allow organizations to get more leverage from their data cloud platform investments through native integrations to popular cloud data warehouses such as Snowflake and Redshift. To accelerate time-to-market for new analytics applications, Domo offers around 1,000 prebuilt connectors. Business users can also integrate data via file uploads or connect to cloud and on-premises databases, applications and services.

Domo is designed for cloud deployment and mobile consumption from the ground up. Low-code and no-code app development capabilities make it easy for customers to quickly build apps that are made available on the web and in the native app for a mobile experience.

A browser is used to access all functionality, although there is a Windows desktop tool called Workbench, which is used to transform and load on-premises data into the Domo cloud. Mobile users can access Domo through its iOS and Android apps. Domo is also investing in advanced analytics and natural language processing to provide greater value to more users in the future.

User & Use Cases

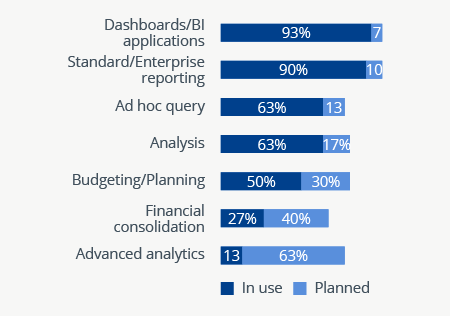

Customers use Domo to distribute information through a variety of application types. Nearly all build dashboards or analytics applications with the solution and the vast majority distributes enterprise reports. Ad hoc queries and analysis are also frequently used. This is no surprise as Domo markets itself as a self-service tool for all users to explore their data and find insights. Customers’ planned use of advanced analysis is indicative of Domo’s investment in artificial intelligence and predictive analytics.

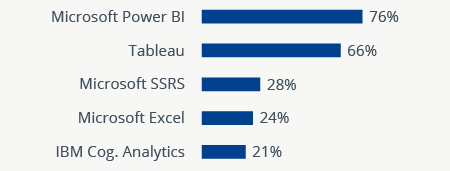

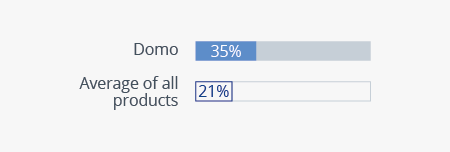

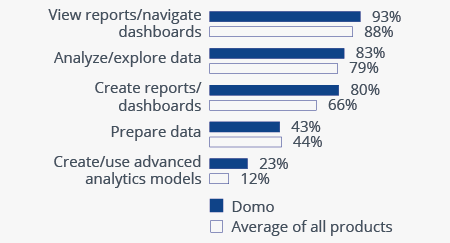

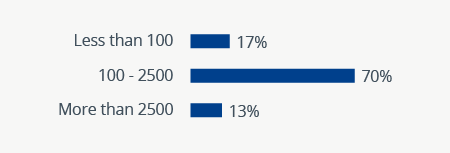

Compared to the average, a higher percentage of Domo users use the tool to analyze and explore data – a finding consistent with recent years. In addition, Domo also has almost twice the average product penetration rate among its customers who are primarily medium-sized and small companies. This speaks to Domo’s focus on non-technical business users throughout the enterprise. The tools most often evaluated in competition with Domo are Tableau, QlikView and Power BI.

Current vs. planned use

n=30

5 products most often evaluated in competition with Domo

n=30

Percentage of employees using Domo

n=30

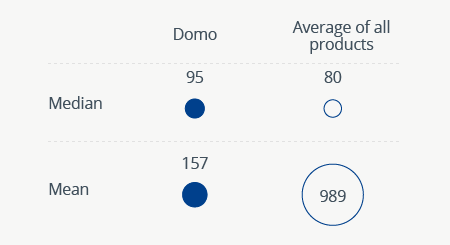

Number of users using Domo

n=30

Tasks carried out with Domo by business users

n=30

Company size (number of employees)

n=30

Want to see the whole picture?

BARC’s Vendor Performance Summary contains an overview of The BI Survey results based on feedback from Domo users, accompanied by expert analyst commentary.

Contact us to purchase the Vendor Performance Summary- Register for a free sample Vendor Performance Summary download

- If you have any questions, feel free to contact us