With its CCH® Tagetik expert solutions, Wolters Kluwer (WKL) offers enterprise-scale performance management software solutions for the office of the CFO as well as other financial and operational adjacencies. The company is a global provider of professional information, software solutions and services within five global operating divisions: Health; Tax and Accounting; Corporate Performance and ESG; Financial Corporate Compliance; and Legal and Regulatory.

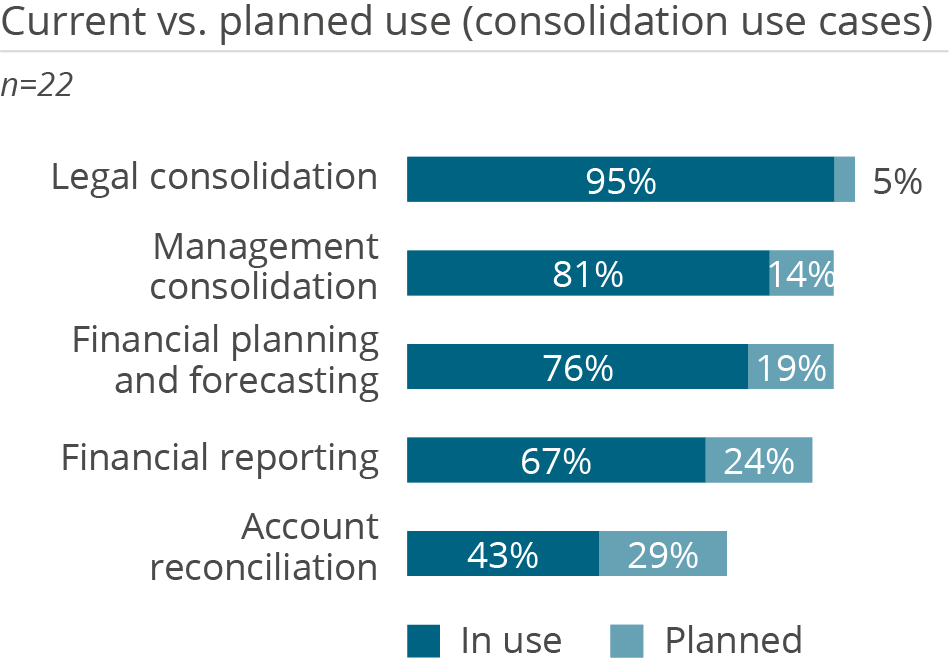

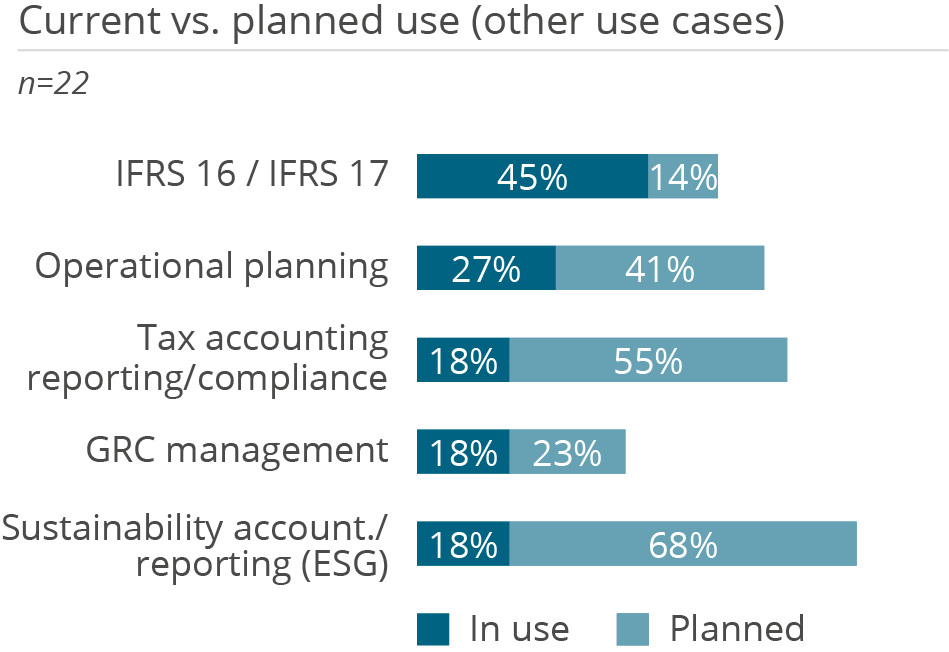

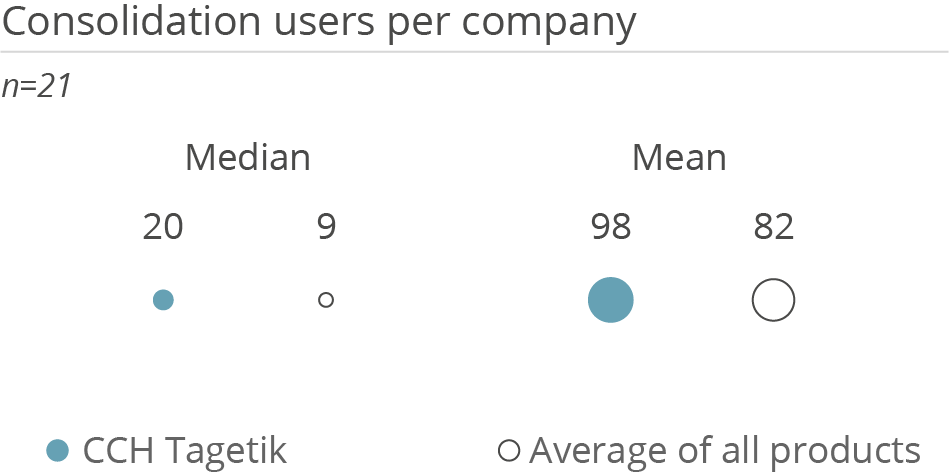

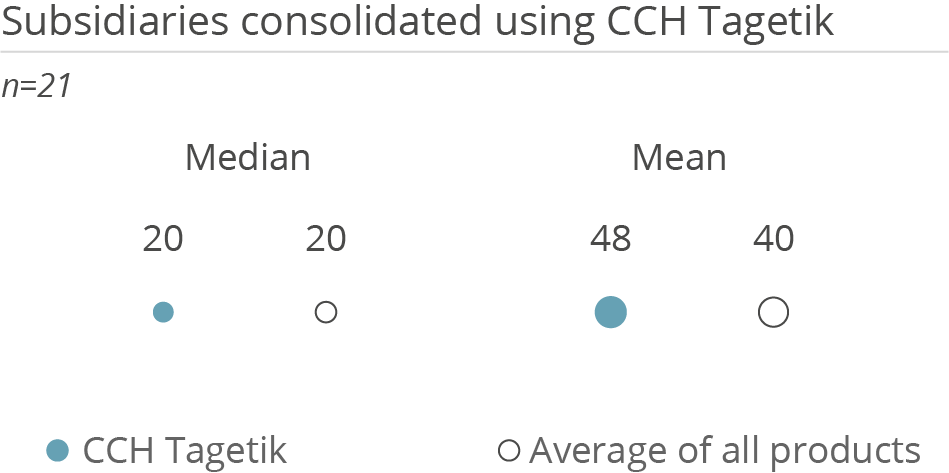

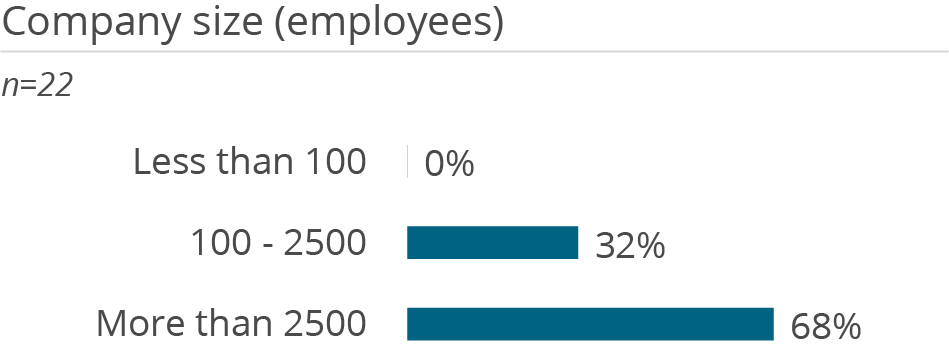

CCH Tagetik provides a unified, finance-owned platform for financial corporate management (financial consolidation and close; budgeting, planning and forecasting; ESG and regulatory reporting; and corporate tax). Used by organizations of all sizes, CCH Tagetik is particularly appealing to mid-sized and large companies (or groups of affiliated companies) with many users involved in corporate planning and/or financial consolidation processes. The comprehensive platform also extends into areas such as account reconciliation; financial reporting, disclosure management and iXBRL; transaction matching; IFRS 16, IFRS 17; and Solvency II. In addition, the CCH Tagetik applications marketplace includes predefined starter kits, pre-packages and tech solutions developed by partners as well as Wolters Kluwer itself. CCH Tagetik is available for deployment in the Amazon (AWS) cloud and on-premises. Microsoft Azure is also available on request. According to the vendor, more than 1,900 customers worldwide across all industries currently use CCH Tagetik.

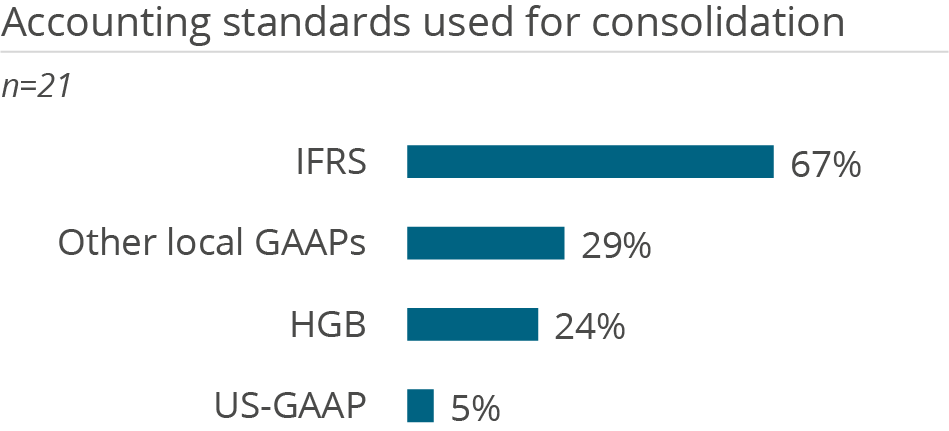

CCH Tagetik offers built-in consolidation functionalities and financial intelligence. The platform contains consolidation rules for all the different consolidation methods – full, proportional, at equity – and a predefined model for financial consolidation, particularly for the investment/equity consolidation. From a consolidation perspective, CCH Tagetik has a strong focus on decentralized web-based intercompany reconciliation with interfaces to transaction systems but also its Microsoft Excel integration for reporting packages. An integrated I/C cockpit supports automated intercompany eliminations. Regarding the different levels of subgroups, CCH Tagetik can perform multiple consolidations simultaneously. Furthermore, if data is available, matrix and segmental consolidations are supported. For debts and income/expense consolidation, individual rules for intercompany matching can be set up, including accounts for posting differences. Following the idea of an integrated financial statement, details such as asset history or changes in equity are included and considered in postings so that data is consistent. As a result, an integrated group cash flow statement is also part of the solution. Finally, consolidation of budget/forecast data is possible thanks to CCH Tagetik’s tight integration of planning and financial consolidation functionality. Each entity can report according to its own local currency, which is translated into the group currency by the system. Comprehensive workflow and governance functionality (especially for bottom-up approaches) is available to control consolidation and planning processes.

The CCH Tagetik platform is underpinned by the Analytic Information Hub, which connects granular financial and operational data with flexible and scalable possibilities in the context of open data modeling, FPM (e.g., regulatory reporting), operational planning and analytics. CCH Tagetik offers extended planning capabilities beyond finance including sales and operations planning as well as functionality for supply chain planning and production planning. From a technical perspective, the CCH Tagetik platform was built with an open and extendable architecture based on a relational data model that supports implementations in Microsoft SQL Server, Oracle, PostgreSQL and SAP HANA. CCH Tagetik continues to empower the office of finance and automate use by leveraging AI and ML for data management – including AI automapping and AI anomaly detection, forecasting, reporting and analytics. For predictive planning and forecasting, CCH Tagetik offers out-of-the-box or customized embedded predictive models and trainable ML capabilities based on Python that can be used to predict future outcomes. A new AI driver-based analysis feature helps to interconnect and correlate data and visually highlights the key drivers. New AI-based intelligent analytics capabilities leveraging GenAI, NLP and LLM have been announced for later this year.

In terms of analytics and reporting, CCH Tagetik pursues a two-fold strategy. The product’s integrated functionality is geared to self-service with on-screen display of reports and dashboards as well as regulatory reporting use cases (e.g., ESG). Reports are created in Excel using a business-user-friendly ‘matrix wizard’. Furthermore, CCH Tagetik’s embedded web-based tool SmartInsight enables dynamic ad hoc reporting and analytics. These capabilities can be supplemented by third-party products (e.g., Microsoft Power BI, SAP and Qlik) accessing CCH Tagetik data via an OData API to allow customers to use their analytics tool of choice.

User & Use Cases

This year we had 22 responses from CCH Tagetik users. At the time of the survey, all of them were using version 5.

Summary of CCH Tagetik highlights

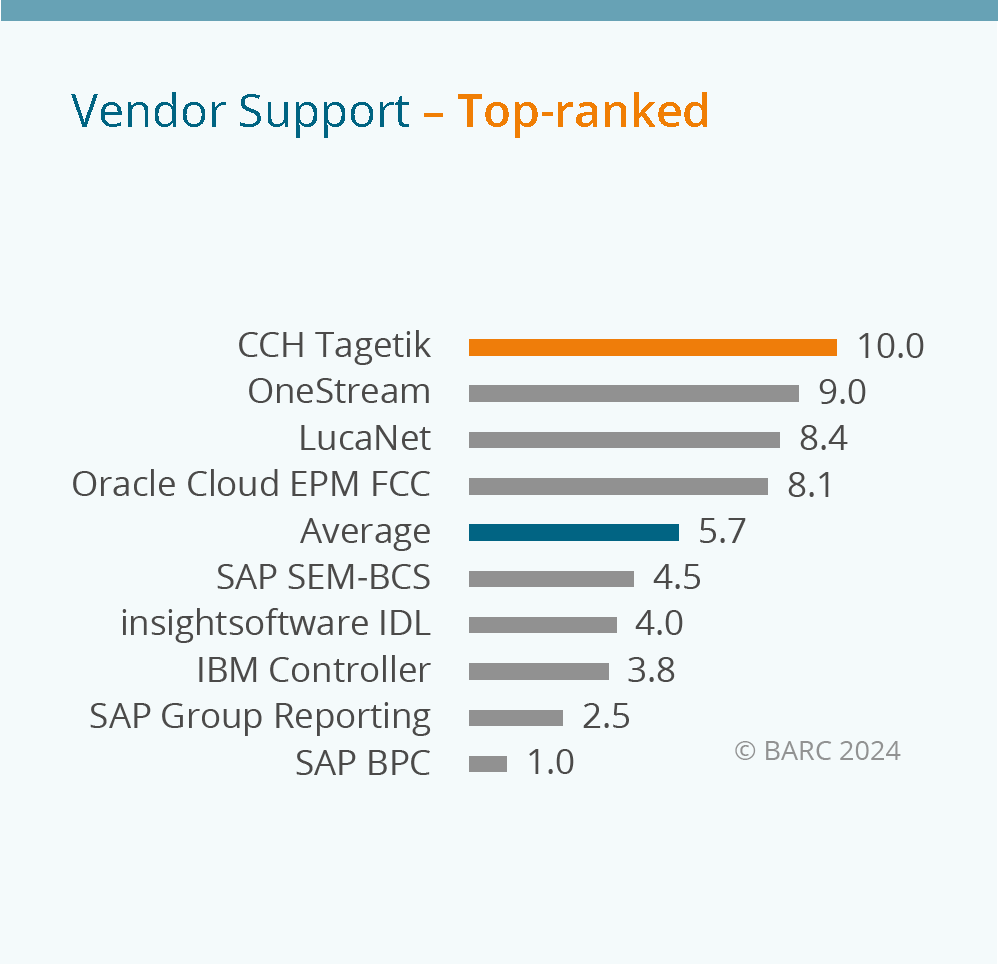

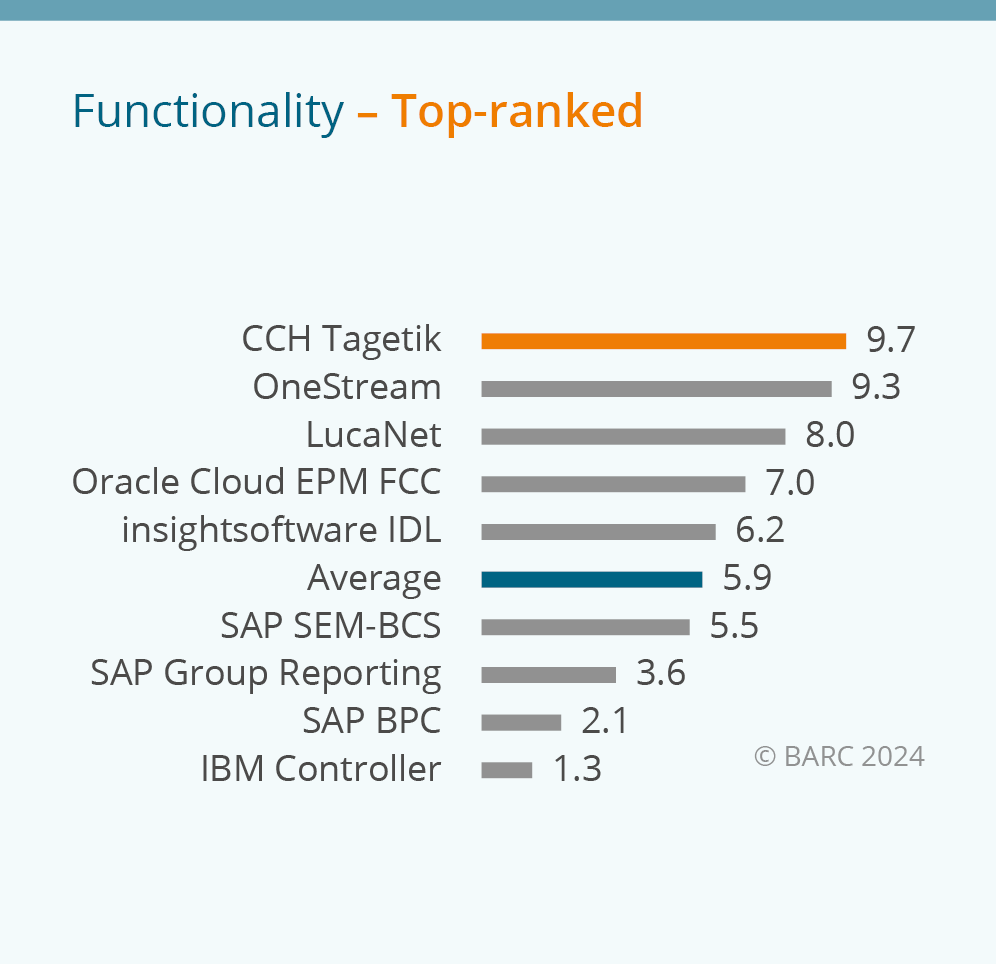

With 11 top ranks and 17 leading positions, CCH Tagetik achieves an outstanding set of results in this year’s Financial Consolidation Survey. Convincing ratings in numerous important KPIs help to consolidate its position as a market-leading financial consolidation and FPM platform that delivers considerable benefits to its customers. Companies can benefit from using CCH Tagetik in terms of increased transparency and traceability of financial consolidation, acceleration of financial consolidation / preparation of financial statements, and better integration of financial consolidation with financial planning.

These benefits lead to a better quality of consolidation results for many customers. 95 percent of CCH Tagetik users say they would “definitely” or “probably” recommend their financial consolidation product to other organizations – a strong result and a great indicator of customer satisfaction with the vendor and its product.