Alteryx, Inc. was founded in 2010 as the successor to SRC LLC, which dated back to its formation in 1997 as a product-focused consultancy specializing in geospatial analytics. The goal of the new company was to extend its software focus beyond location intelligence by providing additional data preparation and advanced analytics capabilities and therefore serve a broader set of analytical scenarios.

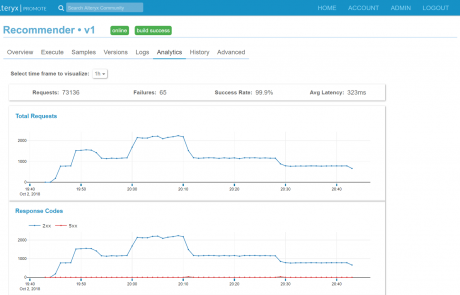

The company went public in March 2017 and is listed on NASDAQ (AYX). In the same year Alteryx acquired Yhat a Advanced Analytics model deployment specialist to strengthen its capabilities in the advanced analytics area. Today, the company employs over 800 people. They serve a total of 4,700 customers spread over more than 70 countries.

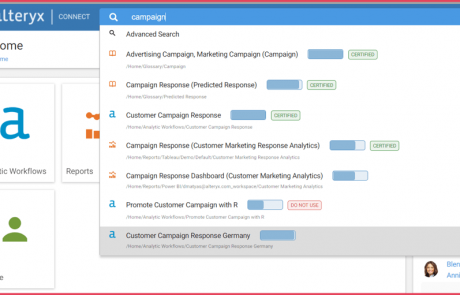

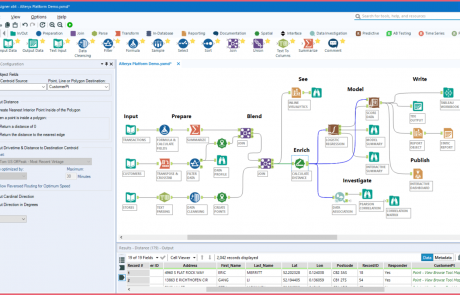

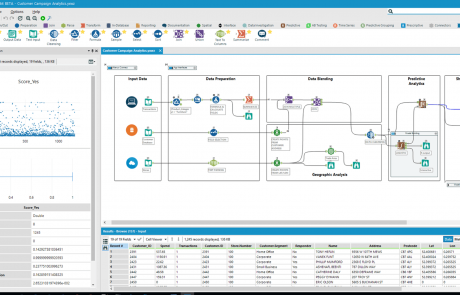

The Alteryx Platform consists of several modules which serve different needs. Designer and Server are the first introduced and still central products which primarily support data preparation and analytical modeling. Connect was a recently introduced data cataloguing module to help users searching for information. Promote results from the Yhat acquisition and focuses on deployment of advanced analytics models. Finally, the module Datasets focuses on the origin of Alteryx, geo analytics by providing spatial features and data.

Alteryx Designer is an installed client which can be tried for free and deployed stand-alone by the customers. These options are based on vendors “land and expand” business model for promotion of its products. When a user discovers the software would be useful for him and his organization this initial purchase often follows other Alteryx platform offerings.

User & Use Cases

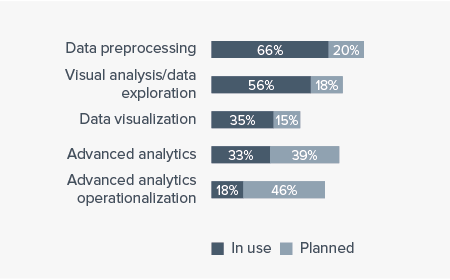

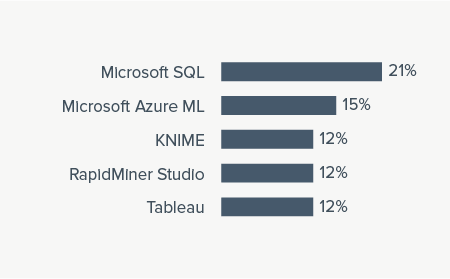

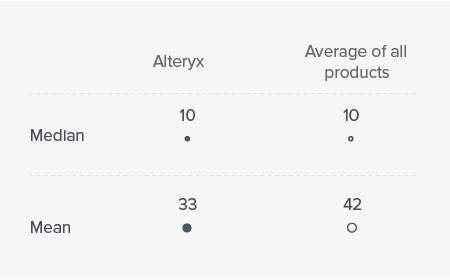

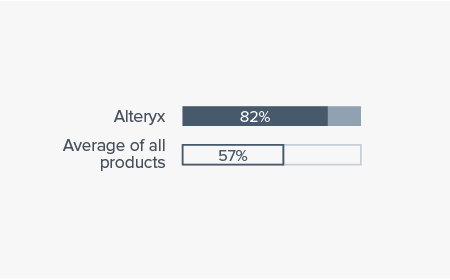

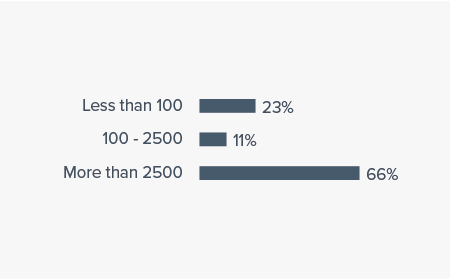

Alteryx is popular for its data preparation and data exploration capabilities. Consequently, most respondents use it for data preprocessing (66 percent) and data exploration (56 percent). Alteryx is most often evaluated in competition with Microsoft SQL Server, which offers strong ETL (extract, transform & load data) capabilities. Alteryx users are predominantly advanced analytics users. It is therefore surprising that only 33 percent of the customers surveyed said they used it for advanced analytics and operationalization. We observe that, in general, analytics projects are often at an early stage (e.g., data preparation, exploration). Hence the use of functionality for advanced analytics modeling and deployment are planned for the future by a significant proportion of customers. Alteryx is predominantly used in large companies.

Current vs. planned use

N=32

5 products most often evaluated in competition with Alteryx

N=34

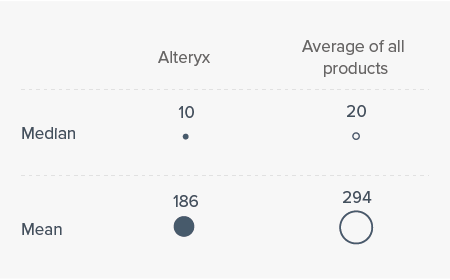

Total number of users per company

N=35

Advanced analytics users per company

N=35

Advanced analytics users (as a percentage of all users)

N=35

Company size (number of employees)

N=35

Summary of Alteryx highlights

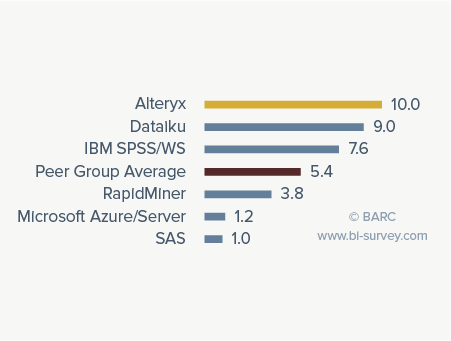

Alteryx software addresses one of the major problem areas for most companies: data access, preparation and management. The vendor is also enhancing its analytical capabilities to enable

companies to make appropriate use of their data and become data-driven.

Customers paint a generally positive picture of Alteryx in this year’s Advanced Analytics Survey. They seem satisfied with the software and the support the vendor provides, and are

likely to recommend Alteryx to others. Moreover they gain value and experience high levels of business benefits as a result of using the product. User feedback also indicates that Alteryx

projects tend to be successfully completed on time and within budget.

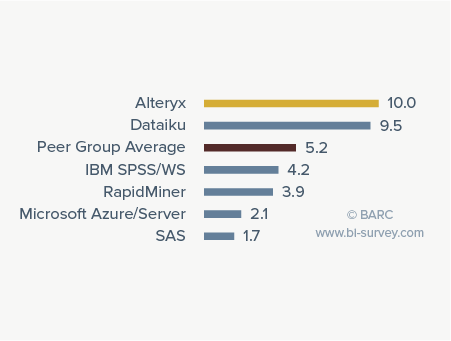

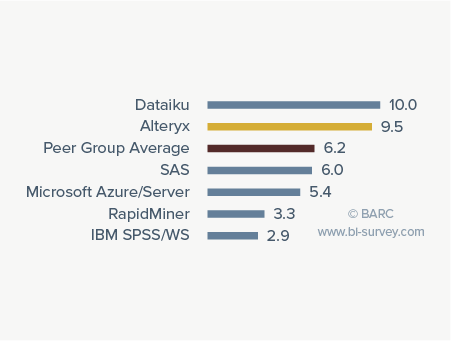

Business value – Top-ranked

Peer group: Advanced analytics platforms

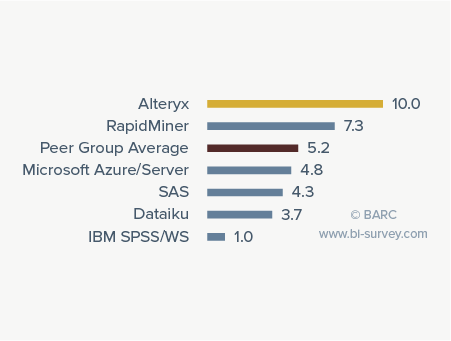

Data preparation – Leader

Peer group: Advanced analytics platforms

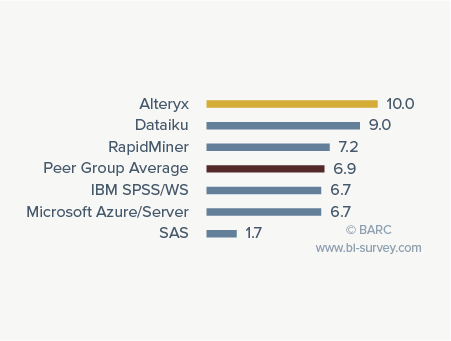

Performance satisfaction – Top-ranked

Peer group: Advanced analytics platforms

Project length – Top-ranked

Peer group: Advanced analytics platforms

Recommendation – Top-ranked

Peer group: Advanced analytics platforms