Before a big data project, companies need to ask themselves a very important question: What do we want to get out of this? It is not easy to answer, especially because big data is still relatively new and empirical data about experiences with it is limited. To shed some light on the subject, we asked respondents to our Big Data Use Cases Survey about their expected and achieved benefits.

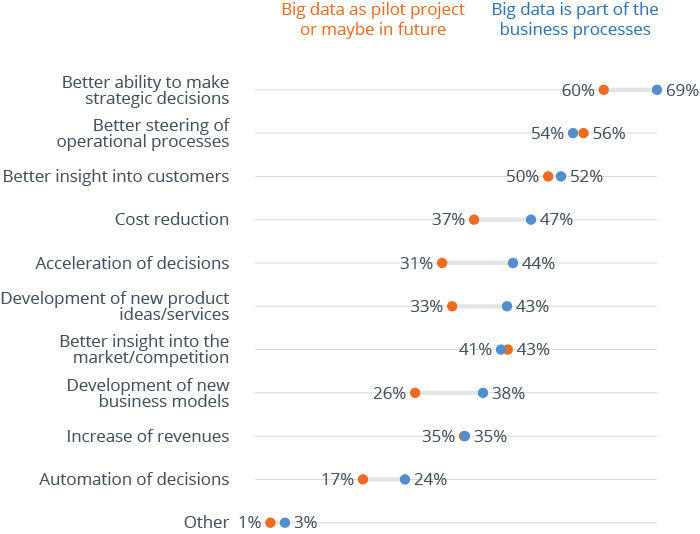

The results show that companies see many different benefits from big data analysis. The ability to make better strategic decisions (69 percent) is the most frequently cited answer. Almost one in two companies have improved their ability to steer operational processes, reduced costs, or improved customer insights/experience.

Expectations for big data, in other words, are broad – from strategic support to steering operational processes. Companies should take this into consideration at the start of each project to avoid making their scope too narrow.

Fortunately, big data initiatives were able to meet – and in some cases even exceed – their relatively high expectations. This especially applies to some of the benefits that are often very difficult to predict and quantify in advance (e.g. the development of new business models and product ideas, faster decisions, cost reduction and the ability to make strategic decisions).

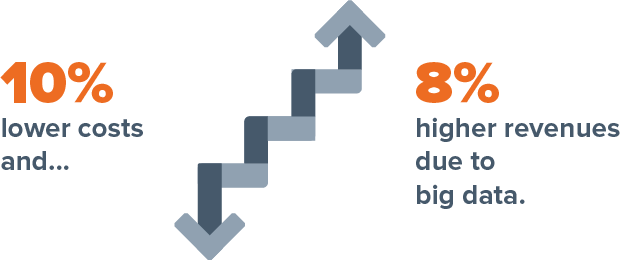

As expected, however, respondents had a difficult time putting these benefits into actual numbers. Only a third of participants (32 of 94) that have integrated big data into their business processes answered this question.

Their responses, however, are impressive. These companies, on average, reported eight percent higher revenues and ten percent lower costs (median values).

A closer look reveals further differences between Europe and North America as well as different industries.

European companies are more likely to successfully use big data to steer their operational processes and develop new product ideas and services. Their North American counterparts, however, have a clear lead when it comes to faster decision-making (37 percent vs. 61 percent). Big data analyses appear to be one reason behind this – and one that companies should not underestimate.

Expectations also differ by industry. Some obvious variances include:

- Retail primarily expects better insights on customers (85 percent), better steering of operational processes (77 percent) and higher revenues (65 percent).

- Manufacturing has above-average expectations for better control over operational processes (66 percent) and cost reductions (43 percent).

- The finance sector primarily wants to use big data analyses to generate new product ideas (52 percent).

To get the most out of your projects, read our recommendations for big data initiatives.

Big Data Use Cases Report

Getting real on data monetization

Request the free report now